Ed Elson, a 26-year-old analyst, often hears stories of previous generations making fortunes in stocks with a sense of regret. Even his podcast co-host, professor Scott Galloway, 60, turned an $800,000 investment in Apple and Amazon in 2009 into $40 million. Elson also longs for a similar opportunity with the companies that defined his generation. In his eyes, those are OpenAI and SpaceX—giant companies with combined valuations of more than $300 billion.

Elson’s story is not unique, but emblematic of a fear called FOMO (Fear of Missing Out) that is creeping into every corner of Generation Z’s financial lives. Gen Z is the new generation of investors, starting to trade on average at 19, much earlier than the baby boomers’ 35. But they are entering a game where the rules seem to have changed.

The half-closed door of the "closed club"

Elson and millions of Generation Zers want to do the same. They look at OpenAI, whose ChatGPT is shaking the world , or SpaceX, whose reusable rockets are shaping the future, and see generation-defining opportunities. But there’s a huge barrier: Neither company is publicly traded.

This is the bitter paradox of Gen Z investors. They are living in an era where the most innovative companies with the most explosive growth potential are choosing to stay in the private markets longer than ever before. Instead of facing the pressure of quarterly reports and public investors, these “unicorns” continue to receive abundant funding from venture capital (VC) funds. According to data from PitchBook, global VC funding has more than tripled in the past decade.

“The people who have access to the highest quality companies are the venture capitalists who are already wealthy. And that’s a big problem for our generation,” Elson said.

This sense of being left behind is not without reason. Jay Ritter, a finance professor at the University of Florida, says that companies today take an average of 14 years to go public. By the time a company finally goes public, its most rapid growth period is often over. An IPO is no longer a sign of “future promise,” but rather a sign that the biggest party is over.

That leaves aspiring investors in a different arena: the secondary market, where shares of private companies are traded. But this is an extremely exclusive club. To join, you must be an accredited investor under the Securities and Exchange Commission (SEC) standards: either a net worth of more than $1 million excluding a home or an annual income of more than $200,000. Only about 13% of Americans meet this criteria.

“It feels like a closed club,” said Vivian Tu, a 31-year-old personal finance educator . “If you’re rich, you’re in. If you’re not, sorry, you’re out.”

Gen Z around the world start investing before the age of 21 because of fear of missing out - FOMO (Illustration: Getty).

"TikTok-ization" of finance - When FOMO meets click

As the doors of the mainstream seem to close, Gen Z is finding their own paths. And this is where financial FOMO meets technology and online culture. Having grown up with viral trends and stories of instant riches, this generation is applying that same urgency to their investment portfolios.

The “TikTokization” of finance is a key driver. Platforms like TikTok, YouTube Shorts, and Discord chat rooms have turned complex concepts like ETFs, options trading, and cryptocurrencies into short, easily digestible lessons.

Financial influencers like Tori Dunlap and Humphrey Yang have made investing accessible, entertaining, and most importantly, created a sense of urgency. Nearly 7 in 10 Gen Zers admit to feeling financial FOMO when scrolling through social media.

Trading apps like Robinhood and Public have broken down the last barrier. With streamlined interfaces, no commissions, and fractional share features, buying a fraction of a Tesla share has become as easy as swiping on Tinder. Investing has become less of a serious financial decision and more of an addictive dopamine hit.

The result has been an unprecedented surge in participation. Pew Research reports that by 2024, 53% of Gen Z adults in the US will own at least one form of investment, up from 34% just two years earlier.

But this democratization also comes with a tribal investing culture. A post on Reddit's WallStreetBets forum can shake up the entire market, as the GameStop saga has demonstrated.

Investing has become a form of “social currency.” Owning a meme stock or a hot cryptocurrency isn’t just a financial decision, it’s a statement about belonging to a community, about “chasing the trend.” No one wants to be the only one who doesn’t understand what’s going on when their friends are talking about “Dogecoin to the moon.”

The Price of "Not Wanting to Be Left Behind"

Gen Z’s fear of missing out doesn’t stop at the stock market. It permeates every aspect of social life and creates a huge financial burden.

A shocking survey by Ally Financial on the “friendship tab” revealed that Gen Z and Gen Y are spending an average of $250 a month on social activities with friends. While three in five admit that this negatively impacts their long-term financial goals, 69% still prioritize seeing friends at least weekly.

With the cost of living rising, from $20 cocktails to expensive concert tickets, maintaining social connections has become a dilemma: spend money, or not spend money. About 20% admitted that financial differences had caused a friendship to fall apart. Nearly 25% blamed the economic downturn for making it difficult to meet friends.

Yet, they still accept "paying to play". About 25% of respondents confirmed that they would rather run out of money than run out of friends. Behind this choice is a fear even greater than the fear of being empty-handed: the fear of loneliness. The World Health Organization (WHO) has warned that loneliness is a serious health threat, equivalent to smoking 15 cigarettes a day. A Gallup survey also showed that Gen Z and Gen Y men in the US are among the loneliest in the world.

Social FOMO, amplified by glamorous Instagram images, has become a powerful spending motivator. Empower research found that more than half of Americans (57%) have made financial decisions after seeing other people’s lifestyles online. The most common FOMO-related expenses were eating out (21%) and travel (18%).

Many Gen Z and Gen Y feel trapped between the fear of missing out on meaningful events and the growing burden of debt (Illustration: Getty).

The double-edged sword - between risk and the desire for autonomy

So where will this FOMO storm take Gen Z? Financial experts offer conflicting perspectives, painting a complex picture of a generation that is both reckless and ambitious.

The dark side of FOMO is incredibly risky. “We advise investors to be careful what they wish for,” warns Matt Kennedy, a strategist at Renaissance Capital. Getting involved in early-stage companies can yield huge returns, but it also means betting on unproven business models.

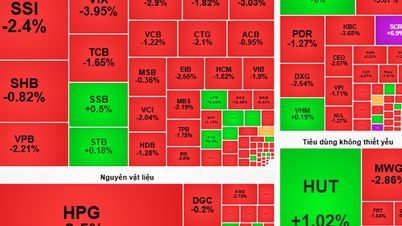

The Figma IPO is a valuable lesson. The stock opened at $85, double the $33 IPO price. Retail investors, unable to buy at the original price, rushed in at the top. Just a few weeks later, the stock price plummeted, leaving many “holding hot coals” while institutional investors made big profits.

The private markets are even riskier. The bankruptcy of pre-IPO exchange Linqto, which is under investigation by the SEC for allegedly selling securities to unqualified investors, is a wake-up call about the lack of transparency and oversight.

Barry Ritholtz, founder of Ritholtz Wealth Management, puts it bluntly: “A private company like OpenAI comes along, and immediately people are coveted, afraid of missing out, and think they can pick up the next one. History shows that the likelihood of that is almost zero.”

But FOMO is also an incredibly positive force. The fear of being left behind has fueled a wave of financial self-education. 66% of Americans actively seek out financial education content on social media.

Seeing other people's success, while provoking comparison, also inspired 71% of people to improve their money habits. More than 15% of people experiencing financial FOMO said it inspired them to invest, while others opened a new savings account (14%) or improved their debt repayment strategy (13%).

More importantly, it reflects a profound psychological shift. Gen Z doesn’t want to follow the safe path of their parents. They feel the current system doesn’t serve them, so they’re deciding to make their own rules.

"There is a desire for control and autonomy, an American-style dynamism: finding your own way, rather than depending on the system," said Juliette Richert, a specialist at The Artemis Fund.

When homes were out of reach and blue-chip stocks were too expensive, they turned to new asset classes: cryptocurrencies, fractional real estate, and collectibles from sports cards to sneakers. As Scott Galloway puts it: “They thought, ‘Okay, forget this. I’m going to create my own asset class. And I’m going to create my own volatility.’”

Fear of missing out (FOMO) is reshaping how a generation defines investing, success, and even friendship (Illustration: QuickFrame).

Gen Z is not a younger version of previous generations of investors. They are the product of a unique era, one marked by inequality of opportunity, ubiquitous digital connectivity, and a constant social pressure called FOMO.

Fear of missing out is both their weakness, driving them into impulsive and risky decisions, and their greatest strength, driving them to explore, learn, and break old financial rules. They are bold, well-connected, and not afraid to challenge Wall Street.

The financial game of this year and beyond is being reshaped by this generation. Financial institutions are having to reinvent themselves, creating more transparent, mobile-first products that combine education, entertainment, and ethics. Because for Gen Z, FOMO is more than just a feeling, it’s a powerful financial force, and it’s not going away anytime soon.

Source: https://dantri.com.vn/kinh-doanh/gen-z-giua-vong-xoay-fomo-khi-noi-so-bo-lo-thay-doi-cuoc-choi-tai-chinh-20250815214041147.htm

![[Photo] General Secretary To Lam chairs a working session with the Standing Committee of the Government Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/cf3d855fdc974fa9a45e80d380b0eb7c)

![[Photo] Science and Technology Trade Union honors exemplary workers and excellent union officials](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/842ff35bce69449290ec23b75727934e)

Comment (0)