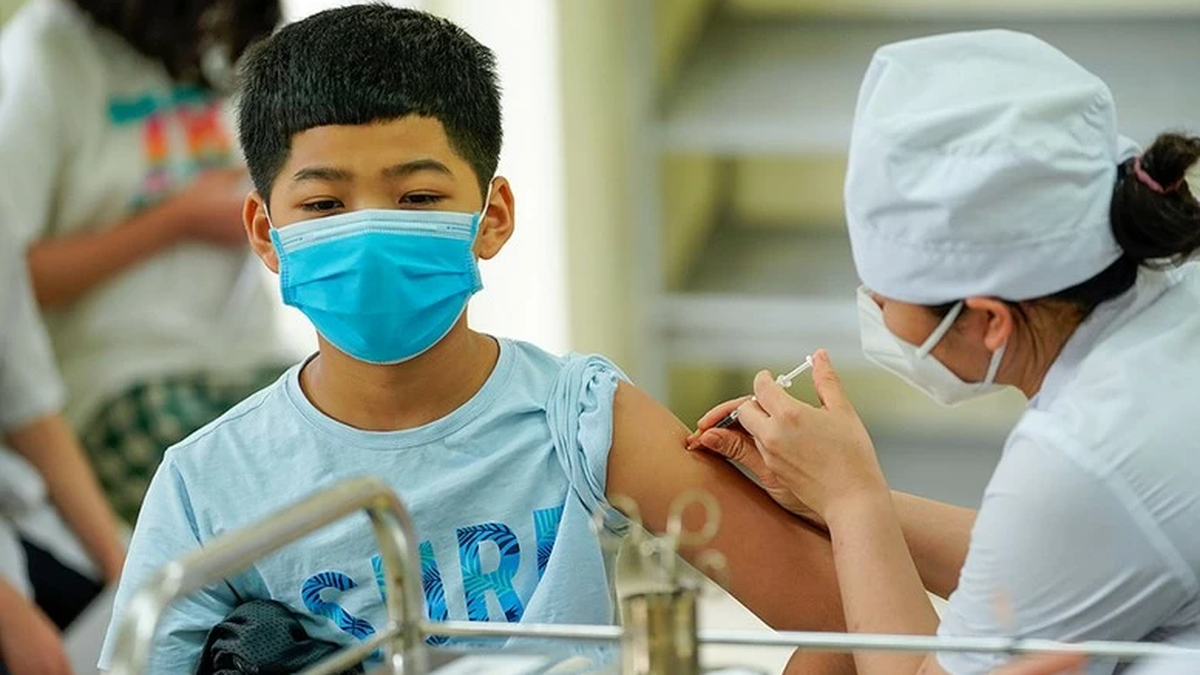

Many households in Minh Son commune have received credit loans to effectively develop the economy .

The State Bank of Vietnam, Region 7, regularly directs local credit institutions to proactively implement policies to remove difficulties for economic sectors, especially the business community. Credit institutions have updated the difficulties of enterprises in production and business activities and in credit relations with banks to have timely support solutions. Son Lam Trading Service Company Limited in Thuong Xuan Commune was granted a credit limit of up to VND 10 billion by Agribank Nam Thanh Hoa to expand production scale. Along with that, the bank has also adjusted the lending interest rate down to about 5%/year, helping enterprises have more conditions to invest, promote production and business.

By mid-July 2025, the outstanding loans of credit institutions in the province reached nearly 250,000 billion VND. The capital has promptly met the capital needs of people and businesses to develop production and business. Credit programs and policies under the direction of the Government and the Prime Minister continue to be effectively implemented in the province, such as: lending policies for agricultural and rural development with outstanding loans reaching nearly 68,000 billion VND, loans for small and medium enterprises reaching 24,800 billion VND; loans to encourage the development of high-tech agriculture and clean agriculture according to Resolution No. 30/NQ-CP of the Government...

Credit institutions have made public the average lending interest rate, the difference between deposit and lending interest rates, and credit packages on each unit's website, helping customers have more information to refer to before accessing loans; promoting consumer lending by electronic means. Banks have also promoted the digitalization of lending processes to shorten loan procedures, bringing many benefits to banks, customers and the economy; increased automation and applied more technologies in the credit granting process; and are studying the application of digital signatures in credit appraisal... The lending interest rate level of credit institutions is at a reasonable level and tends to decrease in most terms compared to the beginning of the year to support local economic development. Short-term lending interest rates are commonly at 5.5% - 7%/year, the maximum short-term lending interest rate in VND for priority sectors is 4%/year; Medium and long term loan interest rates are commonly at 6.5% - 8.5%/year.

Along with that, to facilitate businesses to access capital, Thanh Hoa banking sector also promotes the implementation of the bank-business connection program; diversifying credit programs and products to suit the needs of each target group and customer segment to best serve the credit capital needs of businesses and people. Credit institutions have organized dozens of meetings, exchanges and dialogues with the business community to promptly grasp the difficulties and obstacles in credit relations with banks. By the end of July 2025, banks had committed to lending under the bank-enterprise connection program with an amount of more than VND 25,000 billion, outstanding credit balance of nearly VND 20,000 billion with more than 760 customers with outstanding debt... Notably, in order to achieve the goal of improving the quality of operations, commercial banks and credit institutions in the province have continuously improved the quality of credit work, many debts have been restructured, many borrowers have had their interest rates reduced or exempted, many loans at risk of turning into bad debts have been prevented in time, existing bad debts have been localized and appropriate measures have been taken.

In parallel with credit expansion, the State Bank of Vietnam (SBV) Region 7 is also implementing measures to direct local credit institutions to control risks and ensure system safety, such as: reviewing, detecting and handling "junk" bank accounts - preventing the use of fake accounts for money laundering and financial fraud. Strengthening security in the non-cash payment system, closely monitoring electronic transactions to protect customers from online fraud. With an open credit foundation, strong digital technology and strict management policies, the banking system in the province is creating a solid foundation for breakthrough growth in 2025. Businesses and people need to make the most of this opportunity to access preferential capital sources, promote production and business, and contribute to the sustainable development of the province's economy.

Article and photos: Hong Linh

Source: https://baothanhhoa.vn/dau-tu-nguon-von-tin-dung-phat-trien-kinh-te-255980.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)