In the context of strong digital transformation, online lending is becoming an inevitable trend in the banking industry. This form not only helps people and businesses access capital faster and more transparently, but also opens up new development opportunities for the Vietnamese commercial banking system.

Inevitable trend

Based on transparent payment data, online lending is emerging as an inevitable trend. This is a credit channel that helps people and businesses access capital faster and more transparently, while opening up new development opportunities for the commercial banking system.

In fact, banks have invested in technology, applying artificial intelligence, big data, and biometrics to their products and services. Digital banking platforms, e-wallets, QR payments, and mobile banking are increasingly popular, supporting tens of millions of transactions every day. Technology not only serves payments, but is also used in appraisal, risk management, and customer behavior analysis, helping to reduce social costs and expand capital channels.

Associate Professor, Dr. Dang Ngoc Duc - Director of the Institute of Financial Technology, Dai Nam University said that online lending has become an indispensable part of the digital financial ecosystem of commercial banks. Many banks have recorded outstanding loan growth rates from digital channels that far exceeded expectations, while expanding their service coverage to rural and remote areas - places that were previously difficult to access to traditional financial services.

“Integrating AI, Big Data, and Machine Learning into the credit approval process helps reduce risks, speed up application processing, and improve customer experience. The 2021–2025 period is the hinge for a more transparent and comprehensive digital credit market,” Mr. Duc emphasized.

In Vietnam, 97% of enterprises are small and micro enterprises (SMEs), but most of them still have difficulty accessing capital due to incomplete documents, complicated procedures and high costs. Meanwhile, this group contributes about 40% of the workforce and 18% of total outstanding credit in the system.

Ms. Nguyen Thi Ngoan - MISA's Finance Director - said that MISA Lending was built to directly connect SMEs with banks, based on digital data from accounting software, electronic invoices, and business cash flow. With nearly 400,000 corporate customers using cloud services, this platform provides "live data" to help banks assess risks in real time, limit bad debt and speed up disbursement.

Currently, MISA has connected with 11 banks, granted a limit of nearly 16,000 billion VND and disbursed about 30,000 billion VND, the loan success rate reached 30%, 10 times higher than the traditional model.

Ms. Ngoan added that through the MISA Lending platform, banks can assess the financial capacity of businesses based on both static and dynamic data, thereby minimizing the risk of bad debt. Static data includes credit history, information from the national credit institution (CIC), tax reports and financial obligations. Dynamic data reflects daily cash flow, electronic invoices, accounting and human resources data. This combination provides a more accurate and transparent picture in credit scoring.

On the bank side, Ms. Le Thi Thuy Ha - Director of Digital Lending Project - MBBank Digital Banking Division said that MB is currently deploying 2 platforms APP MBBank and Biz MBBank to provide online banking products and services.

On the MBBank APP platform, MB is serving more than 33 million individual customers. Of which, 100% of individual customers opened accounts and used online banking services at channels with biometric profiles collected successfully via eKYC; 100% of unsecured loans (consumer loans without collateral) were registered and disbursed online; 90.8% of production and business loans were disbursed online, with a cumulative turnover of more than 165,000 billion VND in the first 8 months of 2025.

On the Biz MBBank platform, more than 350,000 corporate customers are being served. Of which, 100% of micro enterprises (Micro SME - mSME) receive and disburse capital through Biz MBBank. All online loan transactions on both the MBBank APP and Biz MBBank use Electronic Contracts with digital signatures, ensuring legality and customer experience.

Improve legal system, increase investment in technology application

For sustainable development, experts believe that technology, data and policy need to be synchronized. Associate Professor, Dr. Dang Ngoc Duc emphasized: “When national data on population, tax and credit are connected, banks can accurately assess debt repayment ability in real time, thereby expanding credit to customers with no previous loan history.”

Along with the law, commercial banks need to upgrade their core banking systems, apply AI, Big Data, Blockchain, IoT to automate the approval process, manage risks and personalize loan products. In addition, bank staff need to be trained in digital thinking, data analysis skills and operate online credit platforms.

In particular, commercial banks need to focus on improving professional capacity, digital thinking and online credit system operation skills for bank staff, from managers to professional staff. At the same time, forming a workforce capable of inter-sectoral coordination between finance, technology and risk management on the basis of training and retraining human resources.

On the management side, Mr. Pham Anh Tuan - Director of the Payment Department of the State Bank said that recently, the State Bank has issued many documents to complete the legal framework for electronic lending. Notably, Circular 06/2023 supplements the regulations on electronic lending in Circular 39/2016, encouraging credit institutions to digitize services, creating favorable conditions for people and businesses to access capital.

In particular, Decree 94/2025/ND-CP on the controlled testing mechanism allows for the first time the implementation of the peer-to-peer lending (P2P Lending) model. The State Bank has provided guidance for the new models to operate in practice but still within the scope of strict supervision, both expanding capital channels and ensuring system safety.

Mr. Tuan also noted that cybersecurity and customer data security must be top priorities. Banks need to invest in security infrastructure, apply AI in monitoring, and strengthen international cooperation on data security.

Some experts say that online lending in Vietnam is growing rapidly but also faces many challenges in perfecting the legal framework, data connection, technology security and risk management. Above all, the decisive factor for success is customer trust.

A clear legal foundation, synchronized data, secure technology and transparent services will build trust, thereby helping digital credit truly become a new driving force of the banking industry in the digital financial era./.

Source: https://www.vietnamplus.vn/cho-vay-truc-tuyen-dong-luc-moi-trong-ky-nguyen-tai-chinh-so-post1061454.vnp

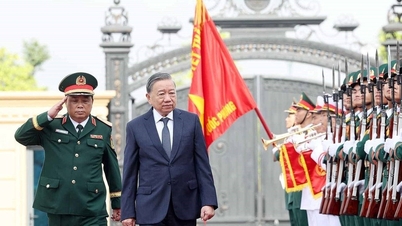

![[Photo] General Secretary To Lam chaired a working session with the Standing Committee of the Party Committee of the Ministry of Foreign Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/f26e945b18984e8a99ef82e5ac7b5e7d)

![[Video] Closing Ceremony of the National Achievement Exhibition on the Evening of September 15, 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a85c829960f340789cb947f8b5709fa8)

![[Photo] Prime Minister Pham Minh Chinh attends the closing ceremony of the exhibition of national achievements "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a1615e5ee94c49189837fdf1843cfd11)

![[Live] Closing of the National Achievements Exhibition "80 Years of Journey of Independence - Freedom and Happiness"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/15/de7064420213454aa606941f720ea20d)

Comment (0)