In order to help business households transform into enterprises easily and effectively, Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ) provides practical and suitable financial-technological solutions.

Resolution 68 and Resolution No. 198/2025/QH15 provide preferential policies for newly established enterprises such as: Exemption from corporate income tax for the first 3 years; elimination of business license fees; support for human resource training costs... Therefore, along with the requirements for transparency in business activities, converting into an enterprise is a strategic step to help transparency and optimize tax obligations (tax calculated based on actual profits instead of paying lump-sum tax like business households); at the same time, helping newly established enterprises open the door to access legitimate credit capital, sign large contracts and affirm their reputation in the market.

|

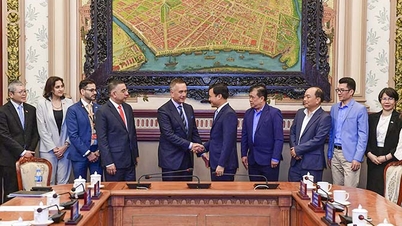

Customers transacting at the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) are advised on suitable financial service packages. Photo: VAN HAI |

BIDV representative said that understanding the needs of newly established businesses, especially retail businesses and businesses on e-commerce platforms when converting to a more professional operating model, BIDV has built a comprehensive digital ecosystem called SME Fast Track - a powerful "support" for businesses to operate smoothly from the very first day. Immediately after completing the business registration procedure, businesses can open an online account 24/7 via eKYC (online customer identification) without having to go to the transaction counter. Beautiful account numbers will be given away for free and the electronic banking system is ready to serve online transactions anytime, anywhere.

In addition, BIDV also integrates the BIDV QR collection solution directly into popular sales software such as: MISA , KiotViet, Mobifone, HENO, Casso, SePay, GoStream, ezCloud... and gives businesses the experience in the early stages, helping to manage revenue automatically, transparently and standardize the entire process. Electronic invoices will also be issued directly on the software in accordance with current tax regulations. Orders after payment into the account are managed and classified, no longer having to check Zalo, messages as before, avoiding confusion and errors in transactions. Cash flow from daily revenue will not stay in one place. With the automatic profit feature, money in the account will be invested flexibly, bringing a minimum yield of 8 times the non-term interest rate, while still ensuring high liquidity, always ready for all spending plans in the process of business expansion. In addition, when there is a need for a loan, businesses can borrow online on the MISA Lending platform with competitive interest rates, supplementing capital quickly and conveniently.

For small and medium-sized enterprises in need of additional working capital, BIDV offers flexible financial loan packages, quick credit response time, competitive interest rates, and diverse products from short-term loans to guarantees and letters of credit. Through the SME Fast Track program, BIDV not only provides financial solutions but also acts as a trusted companion, supporting business households to transform into enterprises in a more professional, transparent and sustainable manner.

Source: https://www.qdnd.vn/kinh-te/tai-chinh/bidv-dong-hanh-cung-doanh-nghiep-but-pha-845383

![[Photo] President Luong Cuong hosts state reception for Governor-General of Australia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/a00546a3d7364bbc81ee51aae9ef8383)

![[Photo] Prime Minister Pham Minh Chinh chairs the 20th meeting of the Steering Committee for important national projects and works](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/e82d71fd36eb4bcd8529c8828d64f17c)

![[Photo] Giant pipeline leading water to West Lake, contributing to reviving To Lich River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/887e1aab2cc643a0b2ef2ffac7cb00b4)

Comment (0)