On August 22, the Ho Chi Minh City Stock Exchange (HOSE) issued a decision to remove HAG shares of Hoang Anh Gia Lai Group from the warning list. The effective date is August 26. The reason is that the company has resolved the cause of the stock being warned according to regulations.

On the same day, Mr. Doan Nguyen Duc - Chairman of the Board of Directors of Hoang Anh Gia Lai (Bau Duc) - announced that he had successfully sold 25 million HAG shares through negotiation. After the transaction, Mr. Duc still owns 28.84% of shares, equivalent to 304,950,533 HAG shares.

In the opposite direction, Mr. Doan Hoang Nam, son of Mr. Duc, also announced the successful purchase of 27 million HAG shares through negotiation. This transaction helped Mr. Nam hold 2.55% of the company's shares for the first time.

With HAG stock price at 16,100 VND/share today, the total value of this transaction exceeded 400 billion VND. This is a significant asset transfer transaction within the family.

Mr. Duc's daughter, Ms. Doan Hoang Anh, currently holds 1.32% of the company's capital, equivalent to 14 million HAG shares.

Stocks hit 10-year high

Since the beginning of August, HAG shares have increased by 21.5%. Over the past year, this stock has increased by 60%.

The increase in shares not only brings joy to Mr. Duc, long-time shareholders, but also creditors who plan to convert VND2,520 billion in debt into shares at VND12,000/share.

The price of VND16,000/share on the stock exchange is equivalent to about VND15,800/share adjusted after additional issuance to convert debt into shares, which is still higher than the issuance price.

5-year trading of HAG shares (Photo: VNDStock).

Receive large capital flows

According to the announced list of bondholders, Huong Viet Investment Consulting Joint Stock Company (Huong Viet Investment) is the largest bondholder of Hoang Anh Gia Lai with nearly 721 billion VND, expected to receive more than 60 million convertible shares, owning 4.74% in case of successful issuance.

Huong Viet Investment is known as a member of the Huong Viet Holdings ecosystem, and is currently the largest shareholder holding 93.37% of OCBS Securities capital. This securities company holds nearly 5 million HAG shares at the end of March 2025.

OCB Bank will become HAGL's new creditor from the fourth quarter of 2024 when lending nearly VND 2,000 billion, and continue to expand the loan balance to more than VND 4,000 billion by the end of the second quarter of 2025.

In addition to the capital flow from OCB, it is worth mentioning the deal that helped Hoang Anh Gia Lai "revive" at the end of 2023, when the group of shareholders related to Mr. Nguyen Duc Thuy and LPBank officially became a comprehensive strategic partner of HAGL company, holding over 5% of shares.

With new resources, Hoang Anh Gia Lai has completely paid off all debts at Eximbank, ending one of the biggest financial burdens that has lasted for many years. At the same time, the company has also successfully restructured large bond debts, significantly reducing maturity pressure and interest costs.

Clear all accumulated losses

In terms of business, in the second quarter of 2025, Hoang Anh Gia Lai's net revenue reached VND2,329 billion, an increase of more than 50% over the same period. After deducting expenses, the company achieved a profit after tax of VND483 billion, an increase of 86%.

In the first 6 months, Hoang Anh Gia Lai achieved 3,709 billion VND in net revenue and 824 billion VND in profit after tax, up 34% and 73% compared to the first 6 months of 2024.

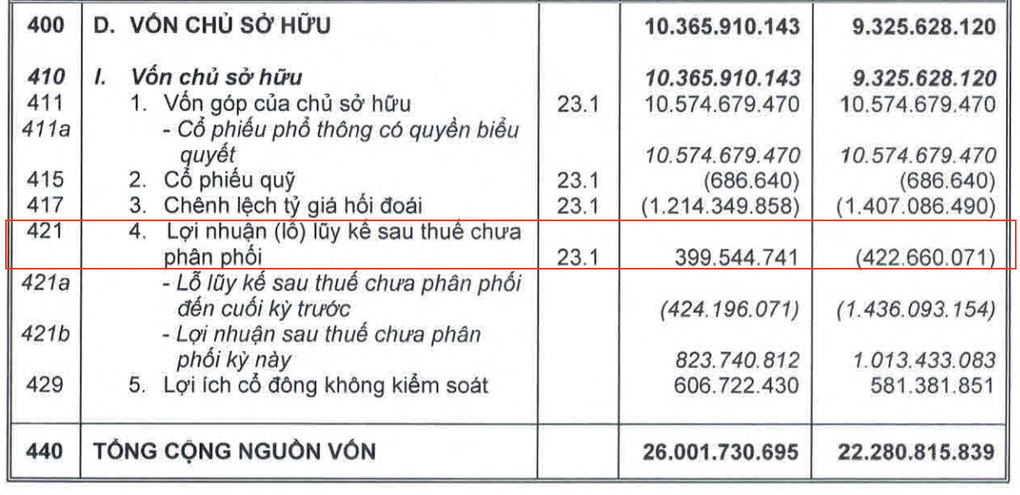

This result helped Hoang Anh Gia Lai achieve 400 billion VND in undistributed profit after tax as of June 30, 2025. This is the first time since the fourth quarter of 2020 that Mr. Duc's company has escaped accumulated losses.

With the results from the first 6 months of the year, HAGL plans to adjust its after-tax profit in 2025 to increase to VND 1,500 billion.

Hoang Anh Gia Lai has ended its accumulated losses (Photo: Taken from the financial statements of the second quarter of 2025).

In addition, in this third quarter, when completing the necessary procedures, the Company will be allowed to record an extraordinary income of more than VND 1,000 billion. Thus, the Company's after-tax profit in 2025 will likely reach VND 2,500 billion.

However, in the semi-annual audited financial report, the auditor still had significant doubts about the group's ability to continue operations, as its short-term debt exceeded its short-term assets by VND2,767 billion.

On August 20, Hoang Anh Gia Lai explained that after-tax profit in the first 6 months of the year increased sharply mainly thanks to gross profit from the fruit segment.

Regarding capital structure, Hoang Anh Gia Lai said it has made a business plan for the next 12 months based on the assumption of continuous operation. In particular, business activities from exporting bananas and durians continue to bring large cash flows to the company along with other measures.

In fact, for many years now, auditors have had the above comments on Hoang Anh Gia Lai's financial statements.

Source: https://dantri.com.vn/kinh-doanh/bau-duc-tiep-tuc-don-tin-vui-20250823111611990.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)