The upside momentum may weaken as the index tops and money cools, but there is still support for an upgrade and a Fed rate cut looming.

Maintained the upward momentum for 4 consecutive weeks

U.S. stocks started the month of September lower but still finished the final week of August with strong gains. The Dow Jones Industrial Average rose more than 3% this month, the S&P 500 gained nearly 2% and the Nasdaq gained 1.6%. Markets were closed for Labor Day on Monday (September 1) and will resume trading on Tuesday (September 2).

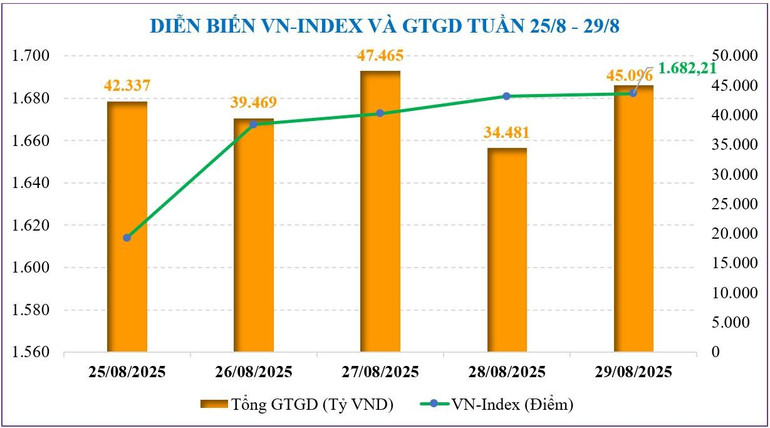

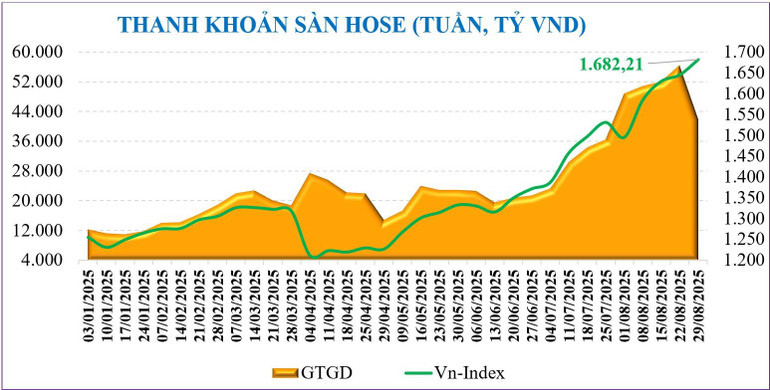

In the domestic stock market, in the last week of August, the VN-Index ended a 4-week and 4-month consecutive increase, closing the last week of August at 1,682.21 points, up +36.74 points, equivalent to an increase of +2.23% compared to the previous week. In addition, this index also increased by nearly +180 points, equivalent to an increase of +12% in August, marking the 4th consecutive month of increase.

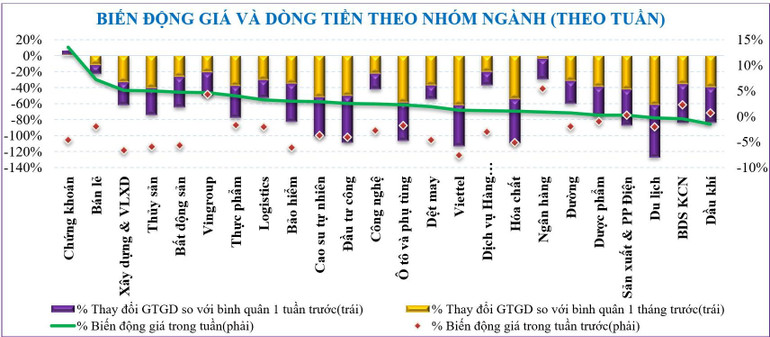

In the last week of August, the increase was mainly concentrated in the Midcap stock group (+3.16%), followed by the VN30 group (+2.83%) and the Smallcap group (+2.22%).

Market breadth improved compared to the previous 2 weeks, reaching 87.5% of groups increasing compared to 54% and 21%. Some groups of stocks with strong increases in the market in the last week of August include: Securities (+13.5%), retail (+7.2%), construction and building materials (+5.1%)... On the contrary, the groups of stocks going against the market include: Oil and gas (-1.5%), industrial real estate (-0.5%).

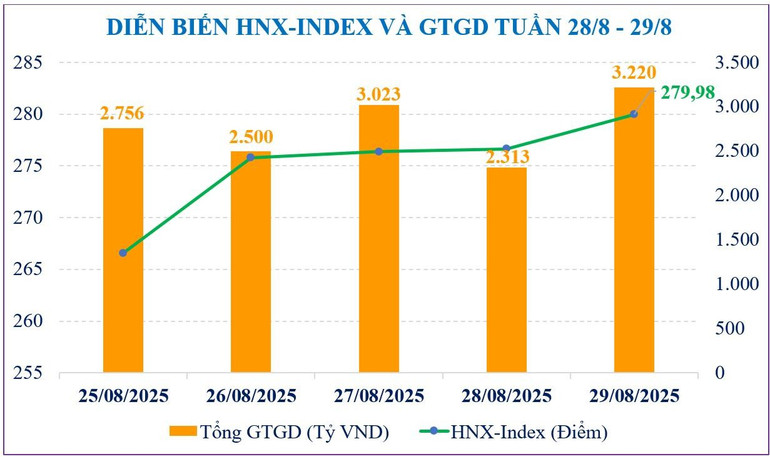

On the Hanoi Stock Exchange, the two main indices also had a positive week of increase. In particular, the HNX-Index increased by +7.5 points, closing the week at 279.98 points, equivalent to an increase of +2.5% compared to the previous week; the UPCoM-Index increased by +1.74 points, closing at 111 points.

Market liquidity last week reached VND45,586 billion, down -26.7% compared to the previous week, of which matched liquidity also decreased -27.7% to VND42,515 billion. According to statistics, August liquidity increased +197% compared to the same period last year and increased +40% compared to July, reaching VND55,120 billion. Accumulated from the beginning of the year, market liquidity reached VND27,640 billion/session, up +31% compared to the average level in 2024, and up +19% compared to the same period.

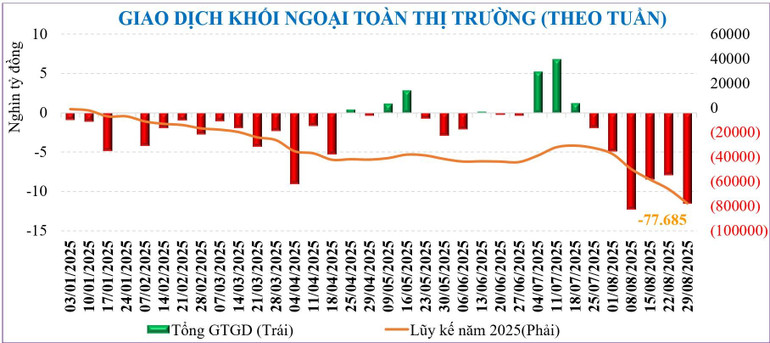

Foreign investors still had a big week of net selling. On the 3 exchanges, foreign investors net sold -11,500 billion VND, marking the 6th consecutive week of net selling, with a cumulative net selling of -77,685 billion VND since the beginning of the year.

In the last week of August, foreign investors net bought GMD (+489 billion VND), VND (+220 billion VND), MSB (+189 billion VND), MWG (+131 billion VND), while net selling HPG (-2,624 billion VND), VPB (-1,448 billion VND), SSI (-894 billion VND), STB (-736 billion VND)...

In terms of valuation, the current market P/E (ttm) is nearly 15.3 times, higher than the 3-year average (13.3 times). The VN30 and Midcap groups are also higher than the average, while the Smallcap group has not yet reached its peak like other groups, so its P/E is currently at 12.9 times, lower than the 3-year average (15.5 times).

The opportunity to increase still exists, despite the pressure to coordinate around the 1,700 point mark.

The domestic stock market is showing some signs of slowing down. However, this is completely understandable as the growth has been going on for the past 4 months. The medium-term growth is expected to remain strong with support from macro-economic growth, upgrades, and the possibility of the Fed cutting interest rates this September.

In terms of points, the increase is slowing down as the VN-Index approaches the 1,700-point threshold. Of the 37-point increase in the last week of August, half of the points came from the Vingroup group (VIC, VHM) contributing nearly 10 points and VCB (nearly 8 points). In addition, strong foreign net selling is restraining the index's increase. According to data from MBS, 2024 is considered a record year of net selling by foreign investors (about -92,000 billion VND), but there has never been a month with strong net selling by foreign investors like last August (-42,700 billion VND).

Liquidity is also a factor that needs to be observed. The liquidity of the whole market has shown signs of peaking at VND62,000 billion, down -27% in the last week of August. Regarding stock groups, except for the securities group that still attracts cash flow and increases by 5% compared to the previous week, the rest all decreased, including some groups of stocks with a decrease of over 50%. Currently, capital flows are mainly concentrated in the banking group (30% weight) and securities 24% (the highest level since the beginning of the year).

In addition to the underlying macro information, or the possibility of the Fed lowering interest rates in September, the focus of the market will be the upgrade information that FTSE Russell is expected to announce on October 7. The group of securities stocks will be an early indicator for the market, currently prominent stocks such as SSI, VND, SHS are higher than the VN-Index at the threshold of 1,700 points. According to MBS experts, the performance of the securities group in the first 2 weeks of September could be an early indicator for the market to be upgraded in early October.

In addition, technically, September is one of the three months with poor performance in the year, and US stocks also have similar seasonal developments. In addition, except for the group of securities stocks that have surpassed their peaks, the leading or capitalization stocks have all peaked and are fluctuating in the re-accumulation zone before the VN-Index. Therefore, in the most positive scenario, most stocks will have to re-test their peaks before forming an extended uptrend. In the base scenario, MBS experts believe that the market will form a re-accumulation zone, possibly around the 1,700-point threshold.

However, investor sentiment and cash flow will be the final deciding factors. If this is positive, it is not impossible that the upward momentum could push the VN-Index towards the resistance level of 1,720 points this September. Therefore, maintaining the portfolio during this period is very important, limiting speculation or focusing on the general index.

Source: https://nhandan.vn/thi-truong-chung-khoan-tuan-moi-vao-vung-tai-tich-luy-quanh-moc-1700-diem-nhung-van-con-tro-luc-nang-hang-post905652.html

![[Photo] Rescuing people in flooded areas at the foot of Prenn Pass overnight](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/19095b01eb844de98c406cc135b2f96c)

![[Photo] Prime Minister Pham Minh Chinh attends the 80th Anniversary of the Vietnam Posts and Telecommunications Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/39a89e5461774c2ca64c006d227c6a4e)

![[Photo] 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/49153e2a2ffc43b7b5b5396399b0c471)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/126697ab3e904fd68a2a510323659767)

![[Photo] Prime Minister Pham Minh Chinh attends the 80th Anniversary of the Vietnam Posts and Telecommunications Group](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/6/39a89e5461774c2ca64c006d227c6a4e)

![[Photo] Many people directly experience beloved Uncle Ho and the General Secretaries](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/2f4d9a1c1ef14be3933dbef3cd5403f6)

Comment (0)