Agribank Thanh Thuy Branch credit officers support customers with disbursement procedures, ensuring customers access loans quickly and conveniently.

With the message “Bringing prosperity to customers”, the branch concretizes the annual business plan, providing solutions to operate business activities suitable to the actual conditions in each locality. Agribank always identifies in business activities, agriculture , rural areas and farmers as the fields and customers that are given top credit priority.

The branch focuses on taking good care of traditional customers, expanding marketing to new customers; effectively implementing the savings mobilization program to promptly meet people's capital needs. Up to now, the mobilized capital of the entire branch has reached 16,654 billion VND, an increase of 14.2% compared to the beginning of the year, reaching 104.3% of the 2025 plan.

To promote credit growth and grasp the economic characteristics of the locality, Agribank Phu Tho Branch requires units in the system to actively improve credit processes and procedures, shorten loan approval time; strengthen coordination with localities to guide customers on skills in managing and using loans, transferring science and technology, organizing production, associated with propaganda and guidance on using bank products and services. Timely inform new regulations on credit policies for agriculture and rural areas; have solutions to remove capital difficulties to help people and businesses operating in the agricultural and rural areas develop production and business.

Agribank credit officers directly go to households to check the production and business efficiency of borrowers in the livestock sector.

Ms. Le Thi Hong Nhung - Director of Agribank Phu Tho said: In order to quickly and conveniently bring Agribank's capital to farmers for investment in production development, affiliated units proactively develop specific credit investment plans for each region, directing credit to priority and key areas. In particular, focusing on credit investment for key agricultural production programs and the province's incentive agricultural production programs; lending for new rural construction...

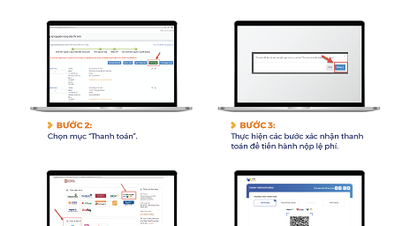

Directing units to diversify credit products and banking services, promoting the supply of products applying appropriate 4.0 technology to encourage people and businesses in rural areas to use modern banking utilities, creating favorable conditions for accessing capital and banking services. Thoroughly grasping the spirit of Agribank staff to proactively innovate transaction style, improve consulting skills, and market customers to use products and services, especially Agribank's e-banking products and services.

Since the beginning of the year, the entire branch has developed 8,778 customers using the Agribank Plus app, mobilized 9,204 customers to open Plus accounts and 6,968 customers to use OTT services.

Not only fully meeting the production and business needs in the operating area, the branch also promptly meets the demand for loans to serve the consumption and living needs of many individuals and households. In particular, promoting loans to customers with legitimate and urgent consumption purposes, with capital needs at reasonable lending interest rates according to regulations.

With the active participation of the entire system, in the first 6 months of 2025, the branch's total outstanding loans to the economy reached VND 16,467 billion, an increase of 7.4% compared to the beginning of the year, reaching 97.2% of the 2025 plan; the bad debt ratio was 0.45%, below the allowable level. To date, outstanding loans in the agricultural and rural sector reached VND 12,953 billion, accounting for 78.7% of the total outstanding loans of the entire branch. This is the clearest evidence of the companionship with "three farmers" as well as affirming Agribank's leading role in this market.

Through credit investment activities for "agriculture and rural areas", Agribank Phu Tho Branch has been contributing with the banking system to build a comprehensively developed agriculture in a modern direction, build a civilized new countryside and constantly improve people's lives, narrowing the income gap between urban and rural areas.

Phuong Thao

Source: https://baophutho.vn/tap-trung-cac-giai-phap-tang-truong-tin-dung-236945.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)