Approval of the Project to Upgrade Vietnam's Stock Market

The general objective of the Project is to contribute to the implementation of the Party and State's guidelines and policies on developing the stock market into an important medium- and long-term capital mobilization channel for economic development, perfecting the market economic institution under State management, and enhancing regional and international economic integration.

Short-term objective: fully meet the criteria for upgrading from frontier market to secondary emerging market by FTSE Russell in 2025; maintain secondary emerging market rating by FTSE Russell.

Long-term goal: meet MSCI emerging market and FTSE Russell advanced emerging market upgrade criteria by 2030.

Group of tasks and solutions to achieve short-term goals

Task group, solutions to meet FTSE Russell's secondary emerging market upgrade criteria:

- Solving the issue of "Request for advance payment to buy securities" to remove the barrier of margin requirement before trading for foreign investors during the time when the Central Clearing Partner (CCP) mechanism has not been implemented for the Vietnamese underlying securities market.

- Transparent information on maximum foreign ownership ratio in all sectors, creating equal access to information for foreign investors.

Task group, solutions to maintain ranking in short term:

- Simplify procedures for registration and account opening for foreign investors, facilitate and reduce procedures for opening indirect investment capital accounts.

- Strengthen the information system between the custodian bank and the securities company to serve investors' securities trading activities (STP).

- Implement the total transaction account (OTA) mechanism.

- Proposing solutions to stabilize the foreign exchange market to respond to fluctuations in foreign investment flows.

- Enhance the capacity of the transaction and payment system to meet large transaction volumes.

- Strengthen the management and supervision capacity of the securities market management agency (State Securities Commission) in terms of personnel, upgrade the information technology system to serve management and supervision. Strengthen coordination within the securities industry and inter-sectoral coordination between the Ministry of Finance, the State Bank of Vietnam and the Ministry of Public Security in supervising activities on the securities market to better support the management work of each industry, improve the effectiveness of crime prevention and suppression, and ensure system security and safety.

Group of tasks and solutions to achieve long-term goals

Task group, solutions to meet the criteria for upgrading to high-end emerging market of FTSE Russell, emerging market of MSCI:

- Review legal regulations on foreign ownership ratio to increase the maximum foreign ownership ratio and remove from the list of industries that do not require restrictions on foreign ownership ratio.

- Develop advanced payment and clearing infrastructure to meet the 100% margin-free transaction payment mechanism and the Central Clearing Counterparty (CCP) mechanism.

- Research and apply a roadmap to allow securities borrowing and lending, controlled short selling through the mechanism of selling pending securities, and intraday trading.

- Develop the foreign exchange market, allowing the implementation of risk hedging tools in the foreign exchange market for indirect investment activities.

- Stabilize macro-financial policy through strengthening close coordination between fiscal, monetary and other macro policies to maintain macroeconomic stability.

Group of tasks and solutions to maintain long-term ranking:

- Strengthen coordination between foreign exchange management agencies and stock market management agencies in regularly monitoring the circulation of foreign indirect investment capital flows.

- Continue to modernize the trading system and securities transaction payment system on the stock market, enhance the capacity of the trading system to meet large transaction volumes. Research and gradually apply new technology to the operations of the stock market.

- Perfecting mechanisms, policies and legal regulations in management and supervision, ensuring security and safety for the stock market and financial system.

Group of tasks, long-term support solutions:

- Increase market liquidity, deploy new order types and trading mechanisms in the stock market, especially order types that suit investors' needs. Develop a system of market makers according to international practices.

- Enhance transparency in the stock market: Strengthen inspection of the quality of operations of auditing units and auditors; implement the Project on applying international accounting standards, encourage large-scale listed enterprises to publish financial statements according to international financial reporting standards (IFRS); enhance corporate governance according to the standards of the Organization for Economic Cooperation and Development (OECD) for public companies.

- Develop, diversify, and restructure the investor base: Strengthen training and disseminate knowledge to domestic investors; encourage individual investors to invest through professional investment institutions (securities investment funds) towards developing institutional investors and investment funds, ensuring the stock market develops in a balanced and stable manner.

- Diversify the commodity base for the market: Research and develop new products such as bonds for infrastructure development, green bonds, options contracts, new futures contracts, structured products, depository certificates, new types of securities investment fund certificates, green financial instruments... suitable to the development level of the market. Improve the quality of current indices, diversify indices, develop additional basic indices as underlying assets for the derivatives market.

Source: https://baochinhphu.vn/phe-duyet-de-an-nang-hang-thi-truong-chung-khoan-viet-nam-102250913224644453.htm

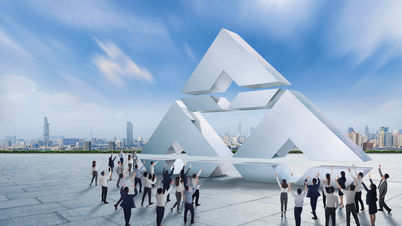

![[Video] Closing Ceremony of the National Achievement Exhibition on the Evening of September 15, 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a85c829960f340789cb947f8b5709fa8)

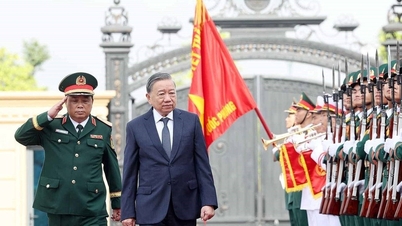

![[Photo] General Secretary To Lam chaired a working session with the Standing Committee of the Party Committee of the Ministry of Foreign Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/f26e945b18984e8a99ef82e5ac7b5e7d)

![[Photo] Prime Minister Pham Minh Chinh attends the closing ceremony of the exhibition of national achievements "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a1615e5ee94c49189837fdf1843cfd11)

![[Live] Closing of the National Achievements Exhibition "80 Years of Journey of Independence - Freedom and Happiness"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/15/de7064420213454aa606941f720ea20d)

Comment (0)