After IPO, 30 days to list shares

The Government has just issued Decree 245 amending and supplementing a number of articles of Decree 155 to resolve a number of difficulties in the operation of the stock market. This Decree officially takes effect from the date of signing, September 11, 2025.

Regarding offering and issuance activities, the newly issued decree adds the responsibility for reporting and disclosing information on capital use, reporting periodically every 6 months from the end date of the offering, the end date of the issuance until the disbursement of all mobilized funds and submitting an audited capital use report at the annual general meeting of shareholders.

For initial public offerings (IPOs), the offering dossier must include a report on contributed charter capital, independently audited.

After IPO and listing at the same time, the time for businesses to list their shares on the stock exchange is shortened to 30 days instead of 90 days as before, helping to better protect investors' rights and increase the attractiveness of the issuance.

Stock market board (Photo: D.D).

For bonds, the conditions for public offering are tightened. Accordingly, issuing organizations or corporate bonds registered for public offering must have a credit rating, except for bonds issued by credit institutions or bonds guaranteed by credit institutions, foreign bank branches, foreign financial institutions, or international financial institutions to pay the entire principal and interest of the bonds.

In addition, the credit rating agency is not a related party of the issuing organization. The new decree also accepts the assessment results of three prestigious global organizations: Moody's, Standard & Poor and Fitch Ratings, helping domestic enterprises save costs.

Reform of offering and issuance procedures

In addition, a series of administrative procedures related to offering and issuance have also been simplified. Specifically, the new decree has removed the provision on the condition of successful offering rate (70%) for the case of offering securities to the public to shareholders according to the ownership ratio.

The new Decree also removes the document component of "the State Bank's approval document on the plan to issue bonds to the public in accordance with the provisions of the law on credit institutions" for the application dossier for public bond offering of credit institutions.

At the same time, remove the condition that "the total amount of money raised from the offering in Vietnam does not exceed 30% of the total investment capital of the project"; reduce the condition that "the offered bond is a bond with a term of not less than 10 years" to a term of 5 years for the public offering of bonds.

Investors trade on the stock market (Photo: D.D).

Decree 245 also aims to remove barriers for foreign investors. In particular, the procedure for recognizing professional securities investor status is adjusted to comply with foreign legal documents, creating convenience when participating in private issuances.

The rights of foreign shareholders are also more clearly guaranteed. The Decree abolishes the provision allowing the general meeting of shareholders or the company's charter to set a foreign ownership ceiling lower than the law, thereby gradually approaching the maximum level of openness according to international commitments.

Public companies that have not yet completed the procedure for notifying the maximum foreign ownership ratio are responsible for completing the notification of this ratio within 12 months.

In addition, the procedure for granting transaction codes to foreign investors has been simplified, allowing transactions to be made immediately after being confirmed by the electronic system, instead of having to wait for a certificate as before. The State Bank has also reformed procedures for opening capital accounts and payments, reducing the time and cost of accessing the market.

Notably, foreign fund management companies are allowed to own two separate trading codes for proprietary trading and client asset management, in accordance with international practices and as a basis for implementing the total trading model (OTA - Omnibus Trading Account) according to international practices.

Source: https://dantri.com.vn/kinh-doanh/loat-diem-moi-go-nut-that-mo-duong-nang-hang-thi-truong-chung-khoan-20250912171428160.htm

![[Photo] President Luong Cuong attends the opening ceremony of the new school year at the National Defense Academy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/c65f03c8c2984e60bd84e6e01affa8a0)

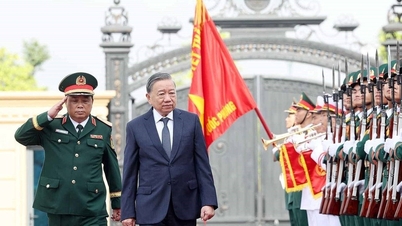

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Department of Defense Industry](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/fb8fd98417bb4ec5962de4f7fbfe0f6a)

Comment (0)