Before the first trading session of the week, most securities companies were inclined towards the scenario that the market would fluctuate strongly and close in red when the VN-Index had recovered for many consecutive sessions on a low liquidity basis.

However, the actual developments were the opposite. VN-Index maintained green throughout the session and widened its increase range towards the end of the session. Cash flow poured into pillar stocks in the banking, securities, and public investment groups... helping the index accumulate more than 17 points, closing at nearly 1,685 points.

The HOSE floor had nearly 240 stocks gaining points, 3 times the number of stocks losing points. Green also dominated the large-cap basket with 22 stocks closing above reference, while 6 stocks lost points.

BID topped the list of stocks with the most positive impact on the VN-Index, accumulating 3.1% to VND42,200. This list has two other representatives of the banking group, CTG and TCB. The rest are evenly distributed across many industries such as aviation, securities, retail, energy, and rubber.

By industry group, securities have the most unanimous increase. After the information that the Government approved the project to upgrade the market, a series of securities stocks increased strongly. VIX led the way when it hit the ceiling of 37,450 VND, while VND, VCI, HCM all increased by more than 1%. SSI, the leading stock in the industry, was sold heavily by foreign investors this morning, so it decreased in points, but by the end of the session, it reversed and increased by 0.7%.

Green also covered the steel group with an increase range of 0.5-2.8%. HPG accumulated 3% at one point, approaching the 31,000 VND mark, but then faced strong selling pressure so it only increased by about 1%.

Similarly, the oil and gas group also closed the session in green. The two pillar codes GAS and PLX accumulated 1.1% and 0.4%, respectively.

In the banking group, the common increase was 1%. Some stocks such as HDB, MSB, VPB went against the market trend, but the decrease was not significant.

Liquidity also showed signs of improvement with more than 1.24 billion shares changing hands, up 10% compared to the end of last week. Trading value also inched up to over VND37,600 billion, of which the large-cap basket contributed nearly VND20,000 billion.

Ho Chi Minh City Stock Exchange has 7 codes with liquidity of thousands of billions. HPG leads with more than 2,700 billion VND. VPB ranks second with more than 2,000 billion VND, far surpassing the following codes such as VIX, SSI,SHB and MSN.

Forecasting this week's developments, the analysis team of MB Securities Company believes that the short-term trend is still up, although this week the market has activities to restructure ETF portfolios and maturity of derivatives.

PV (synthesis)Source: https://baohaiphong.vn/thep-ngan-hang-chung-khoan-giup-vn-index-tang-4-phien-lien-tiep-520829.html

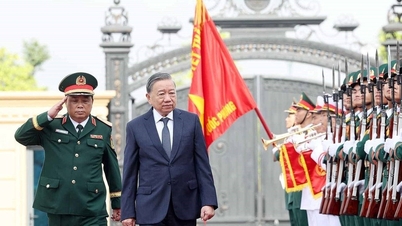

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Department of Defense Industry](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/fb8fd98417bb4ec5962de4f7fbfe0f6a)

![[Photo] President Luong Cuong attends the opening ceremony of the new school year at the National Defense Academy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/c65f03c8c2984e60bd84e6e01affa8a0)

Comment (0)