In the context of the world situation in the coming time, which is forecasted to continue to have many large, complicated and unpredictable fluctuations, the Government and the Prime Minister requested the State Bank to continue to direct the credit institution system to direct credit to production and business sectors, priority sectors, and growth drivers. At the same time, promote short-term lending to support businesses affected by US tariff policies; research and develop credit packages to support people and businesses, such as credit packages for young people to buy houses; a VND500,000 billion long-term loan package for businesses investing in infrastructure and digital technology .

Contribute to economic growth, ensure shareholder rights

The banking sector plays an important role in providing credit and is also a component of the economy. Therefore, the banks' efforts to achieve high growth targets also contribute to the overall growth of the country.

Along with cost reduction, application of science and technology to shorten loan procedures and reduce interest rates, many banks have set out 2025 business plans with double-digit growth targets.

According to documents for the upcoming 2025 Annual General Meeting of Shareholders, the Board of Directors of Saigon-Hanoi Commercial Joint Stock Bank (HoSE: SHB) plans to submit to shareholders for approval a plan to increase pre-tax profit by 25% this year, reaching VND14,500 billion, the highest in the bank's history.

SHB also targets total assets to increase by 11%, reaching VND832,221 billion by the end of 2025. Of which, total outstanding credit is expected to reach VND617,624 billion, up 16% and adjusted according to the limit allowed by the State Bank. The bad debt ratio is expected to be controlled below 2%.

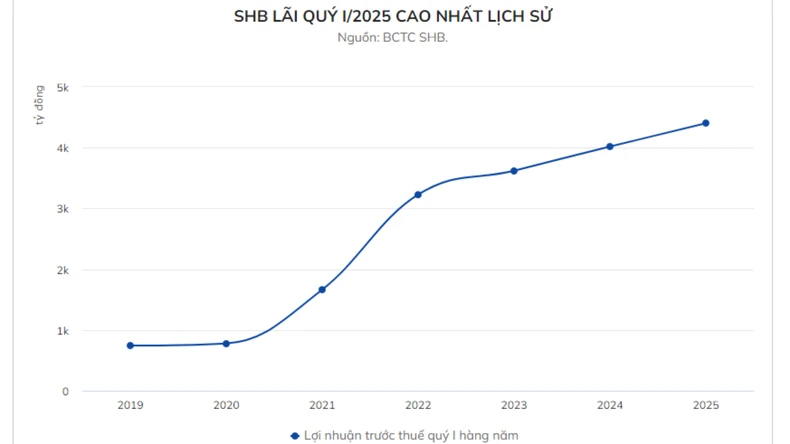

At the end of the first quarter, SHB's pre-tax profit reached nearly VND 4,400 billion, reaching 30% of the 2025 plan. This growth shows SHB's solid internal capacity, and a favorable foundation for breakthrough growth targets in 2025. For many years, SHB has been in the TOP 5 banks with the largest budget contributions.

|

With the mobilization target, the bank aims to mobilize capital in line with the actual credit growth rate, in order to optimize the balance sheet.

Also at the upcoming meeting, SHB plans to submit to shareholders a 2024 dividend plan at a rate of 18% (including 5% cash and 13% stock). Previously, the bank also paid a 2023 dividend to shareholders at a rate of 16% (5% cash, 11% stock). The above dividend rate is expected to continue to put SHB in the group of banks paying the highest dividends in 2025. The 2025 dividend rate is expected to continue to be maintained at 18%.

In fact, over the past decade, SHB has been regularly paying dividends to shareholders at a rate of 10-18%/year. Since 2024, the bank has restored cash dividends after many years of interruption.

With a dividend plan of 18% this year, SHB plans to spend VND7,317 billion to pay shareholders, including more than VND2,000 billion paid in cash and about VND5,300 billion paid in shares. After the issuance, the bank's charter capital is also expected to increase from VND40,657 billion to VND45,942 billion.

With the above growth plan, SHB will continue to maintain its position in the top 5 largest private joint stock commercial banks in the country. Recently, Fitch Ratings announced the results of its first international credit rating for Saigon-Hanoi Commercial Joint Stock Bank (SHB). Accordingly, SHB was rated by Fitch at “BB–” for long-term debt issuance in local and foreign currencies (Long-Term Issuer Default Ratings – IDRs), with a Stable rating outlook, among the top groups in the banking industry.

Fitch is one of the three leading credit rating organizations in the world. Being rated at BB- affirms SHB's reputation and financial capacity in the international market, while reflecting its solid financial foundation and stable profitability.

Deploying key technology projects

To implement the above plan, SHB plans to deploy 5 groups of solutions including: Customer development; Organization and human resources; Information technology and digital transformation; Policy mechanisms, risk management; and Promoting green finance, sustainable development.

Following the direction of the Government and management agencies, especially in implementing Resolution 57-NQ/TW on breakthroughs in science, technology, innovation and national digital transformation, SHB aims to complete the planning of the information technology system, aiming for a long-term roadmap.

In particular, this bank plans to complete the long-term planning of information technology systems in line with the bank's development strategy; Focus resources on implementing the information technology development roadmap, prioritizing solutions to accelerate digital transformation, automate processes and apply advanced technology to banking operations.

Bank of the Future (BOF) will be a key technology project - a project to comprehensively transform the operating and business model on the basis of building a bank with a foundational structure of business processes, operations, advanced customer service capacity, and outstanding management capacity. In addition, SHB will also continue to implement key projects on digital and information technology such as SHB SAHA, SAHA Branch, Core Card, Core Banking upgrade, applications of Big Data technology and artificial intelligence (AI) to enhance customer experience, optimize operational processes and data management, etc.

In addition to ensuring stable, safe and secure operation of the IT system, in 2025, SHB also aims to accelerate digital transformation to optimize digital transaction channels; continue to develop digital payment solutions (QR Code, eKYC, AI Chatbot, etc.); integrate digital ecosystems; and promote comprehensive finance.

Stock breakout

High growth potential, clear transformation plan and ability to pay regular dividends to ensure shareholder rights are the reasons why SHB shares are in the group with the highest average liquidity per session in the current Vietnamese stock market.

By the end of 2024, SHB also has more than 90,000 shareholders, one of the enterprises with the largest number of shareholders in the market.

Since the beginning of 2025, SHB's stock price has also recorded a growth rate that is superior to stocks in the same industry as well as the general market, with an increase of nearly 30%, the highest in the group of banks of the same size. This rate is also significantly higher compared to the performance of VN-Index in the same period, which is minus 3%. In the last month, SHB's stock has increased by nearly 20%.

|

Not only ensuring the rights and interests of shareholders, closely following the direction and orientation of the Government and the Prime Minister on directing credit to production and business sectors, priority sectors, and growth drivers, SHB has launched a credit package of 16,000 billion VND to support young people to buy houses with interest rates from only 3.99%/year, the lowest in the market, applicable until December 31, 2025.

Customers can borrow up to 90% of the value of the property they intend to buy, with no limit on the loan amount and a maximum term of 35 years. In addition, borrowers are exempted from paying principal for up to the first 5 years.

SHB also participates in providing capital for small and medium enterprises and micro enterprises with a credit package of 11,000 billion, interest rate from 6.2%/year, supplementing working capital, investing in production and business and purchasing means of transport.

To support import-export businesses in the current context, SHB is waiving or reducing 66 types of fees, including international payment service fees and account service fees; at the same time, preferential foreign exchange rates of up to 150 points apply to foreign currencies, including: USD, EUR, GBP, JPY, KRW.

SHB representative said that in the context of the economy's increasing capital demand, SHB is always committed to meeting the capital needs of customers and businesses with reasonable interest rates.

Recently, according to a survey by Decision Lab, SHB is the bank with the highest growth rate in customer satisfaction in the past 2 years, in the TOP 5 credit institutions with the highest satisfaction level.

The growth in customer satisfaction that surpasses other banking and financial institutions in the market is the result of SHB's continuous efforts to improve service quality, financial solutions and provide modern, secure utilities to customers.

Entering a new era, SHB continues to ensure shareholders' interests, care about the lives of employees, bring prosperity to customers, shareholders, partners, investors, employees and more broadly, the community and society.

Source: https://nhandan.vn/lay-cong-nghe-la-dong-luc-but-pha-shb-chuyen-doi-manh-me-phat-trien-ben-vung-trong-ky-nguyen-moi-post874244.html

Comment (0)