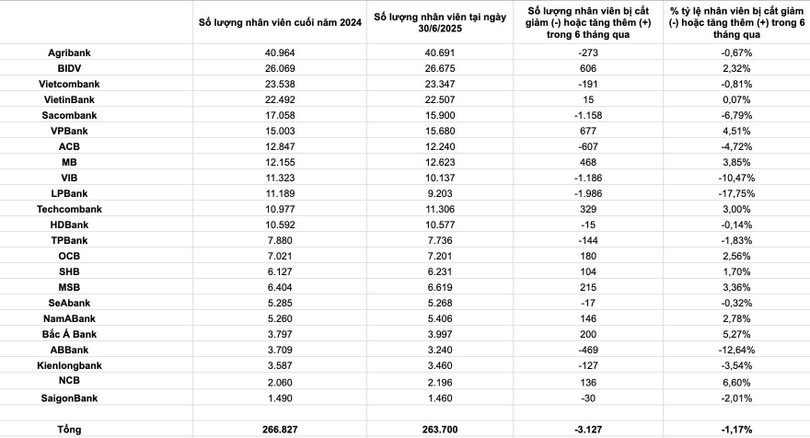

The first 6-month financial reports of 23 commercial banks have been released, showing that the total number of employees working at parent banks as of June 30 was 263,700. Compared to the beginning of the year, the number of bank employees has decreased by more than 3,100 people. This is the sharpest decrease in the same period in recent years, reflecting the strong restructuring trend taking place within banks.

Thousands of LPBank , Sacombank, VIB employees lose their jobs

Leading the charge in terms of staff cuts since the beginning of the year is LPBank. In just the first two quarters of the year, this bank has cut 1,986 employees, equivalent to nearly 18% of its workforce compared to the end of last year, the largest reduction in the entire industry.

According to LPBank's leadership, this is the result of a series of reform measures being implemented by the bank. From streamlining the apparatus, eliminating intermediate levels, standardizing operating processes, to applying technology to automate manual tasks, all aim to create an efficient, flexible and focused operating system.

Along with that, LPBank also promotes decentralization to frontline units, thereby significantly reducing administrative workload and focusing resources on high-value activities.

In particular, along with the above trend of drastically cutting the number of employees, LPBank also attracted attention when allowing employees to take time off from 3:00 p.m. every Friday. This is considered the next step, clearly demonstrating the management perspective of the board of directors when placing trust in work performance instead of pure presence time.

“We aim for an efficient, streamlined organization where each employee works with clear goals and specific results. When the organization is flexible enough and can measure its effectiveness, there is no need to stick to traditional time frames anymore,” LPBank Chairman Nguyen Duc Thuy said about the recent changes in the bank’s personnel and working hours.

Not only LPBank, Sacombank and VIB are also in the group of banks that tend to drastically cut personnel. In the past 6 months, Sacombank has cut 1,158 employees at the parent bank, equivalent to a 7% reduction in total employees compared to the end of last year, while this figure at VIB is 1,186 people (-11%).

Previously, Sacombank Chairman Duong Cong Minh affirmed that the trend of cutting staff is part of the bank's digital transformation plan.

Mr. Minh said that in 2024, Sacombank had reduced nearly 500 employees and in the period of 2025-2026, this strategy will continue to be promoted. The bank will reduce staff at traditional transaction offices and shift to increasing activities in the digital space.

In fact, Sacombank has gradually reduced its workforce since the beginning of 2024, when its workforce decreased from more than 17,400 people at the beginning of the year to 17,058 people at the end of the year. In recent years, this bank has chosen to streamline instead of expanding its recruitment massively as before.

OnVIB's side, the process of cutting staff will also start from 2024, after two years of continuous recruitment expansion in the 2022-2023 period. By the end of 2023, the number of employees at parent bank VIB was 11,799 people. Thus, after only about 18 months, VIB has cut nearly 1,700 employees.

Dozens of banks cut staff

In addition to the three banks mentioned above, nine other banks have also cut staff in the first half of this year. Of these, the Big 4 state-owned banks including Vietcombank reduced 191 employees, while Agribank was not out of the trend with a reduction of 273 employees.

In the private banking sector, many “big guys” have also entered the digital transformation phase to adjust their apparatus. ACB is the bank with the strongest reduction with 607 employees leaving the system; followed by ABBank with 469 employees, TPBank with 144 employees and KienlongBank with 127 employees. Some banks recorded lighter fluctuations, such as HDBank with 15 employees, SeABank with 17 employees, and Saigonbank with 30 employees.

On the contrary, some banks continue to expand their recruitment scale.

Notably, BIDV recruited 606 new employees in just 6 months, VPBank even more with 677 new employees, while MB also recorded an impressive increase with 468 employees. Parent bank Techcombank also managed to add 329 more employees compared to the end of last year.

Many other private banks such as VietinBank, OCB, SHB, MSB, NamABank, BacABank and NCB also tend to expand their staff. The increase ranges from a few dozen to more than 100 employees, showing that the restructuring and expansion of operations is still taking place vigorously in the industry.

In the long term, many bank leaders assess that the trend of streamlining the apparatus can last until at least 2030. However, positions related to technology, data, artificial intelligence and cybersecurity will continue to be prioritized for recruitment.

Particularly for the group of traders, recruitment standards have also been significantly raised. These positions not only undertake data entry or transaction processing tasks as before, but also take on the role of cross-selling products, digital technology consulting and supporting customers to optimize cash flow, similar to a personal financial consultant.

Mr. Dinh Duc Quang, Director of Currency Trading Division, UOB Vietnam Bank, assessed that banks are mainly cutting staff in operational and administrative departments, while recruitment needs are shifting to direct business, consulting and product sales positions.

Manual, repetitive tasks will gradually be replaced by automation technology. However, positions that require communication skills, the ability to connect and persuade customers are still areas where humans play an irreplaceable role.

Ms. Ngo Lan, Director of Navigos Search in the North, said that the pressure of digital transformation is forcing banks to streamline their apparatus and only retain personnel who truly meet the requirements. Technology is the biggest cause of the current wave of layoffs in the banking industry.

However, according to Navigos, despite cutting down on total staff size, many banks are still recruiting new employees, focusing mainly on sales, marketing and especially technology.

Source: https://baohatinh.vn/hon-3000-nhan-vien-ngan-hang-mat-viec-tu-dau-nam-post293066.html

![[Maritime News] Two Evergreen ships in a row: More than 50 containers fell into the sea](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/4/7c4aab5ced9d4b0e893092ffc2be8327)

Comment (0)