|

| Illustration photo. |

In today's trading session, the price of gold bars and gold rings of domestic brands increased sharply, breaking all previous records. The world gold price also skyrocketed due to the news that the FED may cut interest rates next September.

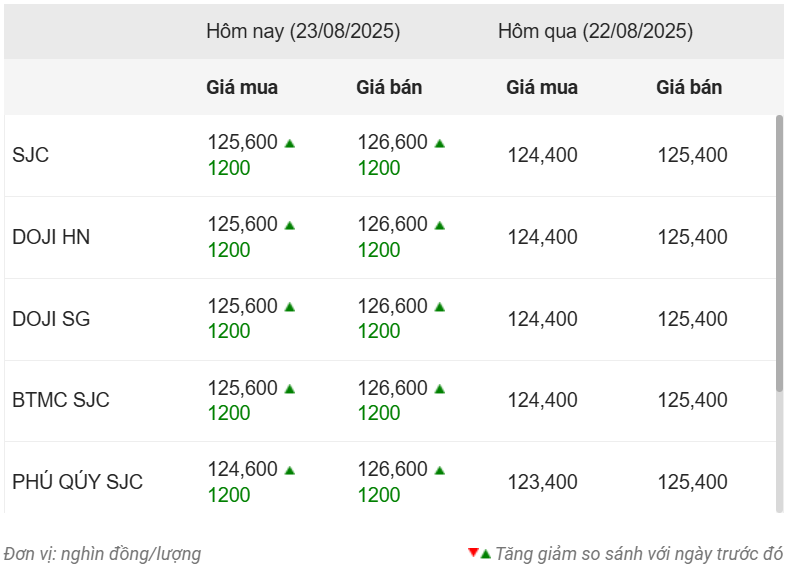

Specifically, at 10:30 a.m. on August 23, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 125.6-126.6 million VND/tael, an increase of 1.2 million VND per tael for both buying and selling compared to the previous session. The difference between buying and selling was 1 million VND.

|

| Gold price statistics of Dragon Viet Online Service Joint Stock Company VDOS - Updated at 10:30 a.m. on August 23. |

SJC 9999 gold ring price is 118.5 million VND/tael for buying and 121 million VND/tael for selling, up 1 million VND/tael in both directions (buying - selling).

Meanwhile, DOJI gold bar price in Hanoi and Ho Chi Minh City was bought at 125.6 million VND/tael and sold at 126.6 million VND/tael, an increase of 1.2 million VND per tael in both buying and selling compared to the previous session's close.

This brand listed the price of Doji Hung Thinh Vuong 9999 gold ring at 118.5-121.5 million VND/tael (buy - sell).

PNJ Gold listed buying price at 118.5 million VND/tael and selling price at 121.5 million VND/tael, an increase of 1 million VND per tael in both buying and selling price compared to the previous session.

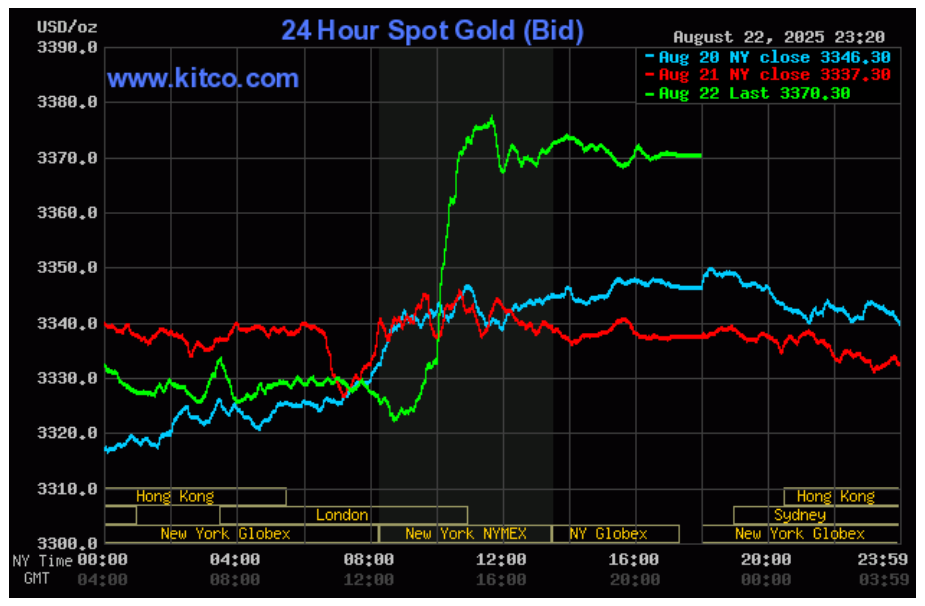

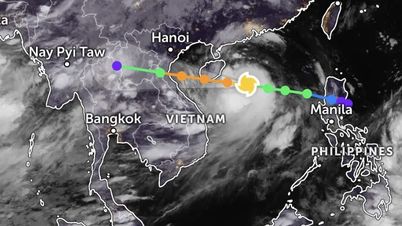

As of 10:30 a.m. on August 23 (Vietnam time), the world gold price increased by 33 USD/ounce compared to the previous session to 3,370.3 USD/ounce.

|

| World gold price chart on August 23. (Photo: kitco.com) |

World gold prices reversed and increased sharply right after the speech of FED Chairman Jerome Powell at the annual Economic Policy Symposium held in Jackson Hole.

Mr. Powell emphasized that the growing economic risks due to rising inflation and slowing economic activity could cause the Fed to adjust its policy stance. However, Mr. Powell did not make a clear commitment to cut interest rates.

Traders are now pricing in an 85% chance the Fed will cut rates by 25 basis points in September, up from 75% before the speech, according to CME's FedWatch tool.

Faced with this information, the USD reversed and weakened. Investors increased their purchases of gold to reserve capital and seek profits from this asset, instead of holding USD, thereby helping the world gold price to increase.

Today, the USD-Index fell to 97.72 points; the yield on 10-year US Treasury bonds was at 4.258%; US stocks rose sharply on the possibility of a Fed rate cut; world oil prices increased, trading around 67.73 USD/barrel for Brent oil and 63.66 USD/barrel for WTI oil.

Source: Nhan Dan Newspaper

Source: https://baodongnai.com.vn/kinh-te/202508/gia-vang-ngay-23-8-tang-12-trieu-vang-mieng-sjc-thiet-lap-dinh-lich-su-moi-9a60efc/

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Infographic] How has the gold market fluctuated in the past 4 months?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/1/51f36dda94bc46fda285a8af2856036b)

Comment (0)