Update gold price this afternoon June 9, 2025 in domestic market

At the time of survey at 3:00 p.m. on June 9, 2025, domestic gold prices recorded a strong upward trend at most major brands. With an increase of several hundred thousand to nearly 1 million VND/tael, today's gold price has reached 117.7 million VND/tael in the selling direction at many units. Specifically:

In Hanoi , SJC gold price is listed at 115.7 million VND/tael (buy) and 117.7 million VND/tael (sell), up 800,000 VND and 500,000 VND/tael respectively compared to yesterday.

At DOJI Group, the price of SJC gold bars also increased sharply, reaching 114.9 million VND/tael for buying and 117.7 million VND/tael for selling. Compared to yesterday, the price increased by 800 thousand VND/tael for buying and 500 thousand VND/tael for selling.

At Mi Hong Jewelry Company, the price of SJC gold was adjusted to VND116.2 million/tael (buy) and VND117.2 million/tael (sell). The recorded increases were VND1.2 million and VND700,000/tael, respectively, compared to the previous session.

At PNJ, the price of SJC gold bars was traded at 115.7 million VND/tael (buy) and 117.7 million VND/tael (sell), up 800 thousand VND and 500 thousand VND/tael respectively. Meanwhile, PNJ 9999 plain gold rings also increased by 500 thousand VND in the buy direction, reaching 111.5 million VND/tael, and increased by 400 thousand VND in the sell direction, reaching 114 million VND/tael.

At Bao Tin Minh Chau, SJC gold price is listed at 115.7 million VND/tael (buy) and 117.7 million VND/tael (sell), an increase of 800 thousand VND for buying and 500 thousand VND for selling.

In Phu Quy, today's gold price is trading at 115 million VND/tael (buy) and 117.7 million VND/tael (sell), an increase of 500 thousand VND in both directions compared to yesterday.

Gold price list this afternoon June 9, 2025 in the country in detail:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 115.7 | ▲800K | 117.7 | ▲500K |

| DOJI Group | 114.9 | ▲800K | 117.7 | ▲500K |

| Red Eyelashes | 116.7 | ▲1200K | 117.7 | ▲700K |

| PNJ | 111.5 | ▲500K | 114.0 | ▲400K |

| Vietinbank Gold | 117.7 | ▲500K | ||

| Bao Tin Minh Chau | 115.7 | ▲800K | 117.7 | ▲500K |

| Phu Quy | 115.0 | ▲500K | 117.7 | ▲500K |

| 1. DOJI - Updated: 06/09/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 115,700 ▲800K | 117,700 ▲500K |

| AVPL/SJC HCM | 115,700 ▲800K | 117,700 ▲500K |

| AVPL/SJC DN | 115,700 ▲800K | 117,700 ▲500K |

| Raw material 9999 - HN | 108,500 | 112,000 |

| Raw material 999 - HN | 108,400 | 111,900 |

| 2. PNJ - Updated: June 9, 2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC PNJ gold bars | 115,700,000 ▲800,000 | 117,700,000 ▲500,000 |

| PNJ 9999 plain gold ring | 111,500,000 ▲500,000 | 114,000,000 ▲400,000 |

| Kim Bao 9999 Gold | 111,500,000 ▲500,000 | 114,000,000 ▲400,000 |

| Gold Phuc Loc Tai 9999 | 111,500,000 ▲500,000 | 114,000,000 ▲400,000 |

| PNJ Gold Bar - Phuong Hoang | 111,500,000 ▲500,000 | 114,000,000 ▲400,000 |

| PNJ 9999 Gold Jewelry | 111,000,000 ▲500,000 | 113,500,000 ▲500,000 |

| PNJ 24K Gold Jewelry | 110,890,000 ▲500,000 | 113,390,000 ▲500,000 |

| 99 gold jewelry | 109,970,000 ▲500,000 | 112,470,000 ▲500,000 |

| 916 Gold (22K) | 101,570,000 ▲460,000 | 104,070,000 ▲460,000 |

| 18K PNJ Gold | 77,780,000 ▲380,000 | 85,280,000 ▲380,000 |

| 680 Gold (16.3K) | 69,830,000 ▲340,000 | 77,330,000 ▲340,000 |

| 650 Gold (15.6K) | 66,430,000 ▲330,000 | 73,930,000 ▲330,000 |

| 610 Gold (14.6K) | 61,890,000 ▲310,000 | 69,390,000 ▲310,000 |

| 14K PNJ Gold | 59,050,000 ▲290,000 | 66,550,000 ▲290,000 |

| 416 Gold (10K) | 39,870,000 ▲210,000 | 47,370,000 ▲210,000 |

| 375 Gold (9K) | 35,210,000 ▲180,000 | 42,710,000 ▲180,000 |

| 333 Gold (8K) | 30,110,000 ▲170,000 | 37,610,000 ▲170,000 |

| 3. SJC - Updated: 06/09/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 115,700 ▲800K | 117,700 ▲5 00K |

| SJC gold 5 chi | 115,700 ▲800K | 117,720 ▲5 00K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 115,700 ▲800K | 117,730 ▲5 00K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 111,500 ▲300K | 113,800 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 111,500 ▲300K | 113,900 ▲300K |

| Jewelry 99.99% | 111,500 ▲300K | 113,200 ▲300K |

| Jewelry 99% | 107,579 ▲297K | 112,079 ▲297K |

| Jewelry 68% | 70,233 ▲204K | 113,800 ▲204K |

| Jewelry 41.7% | 40,459 ▲125K | 47,359 ▲125K |

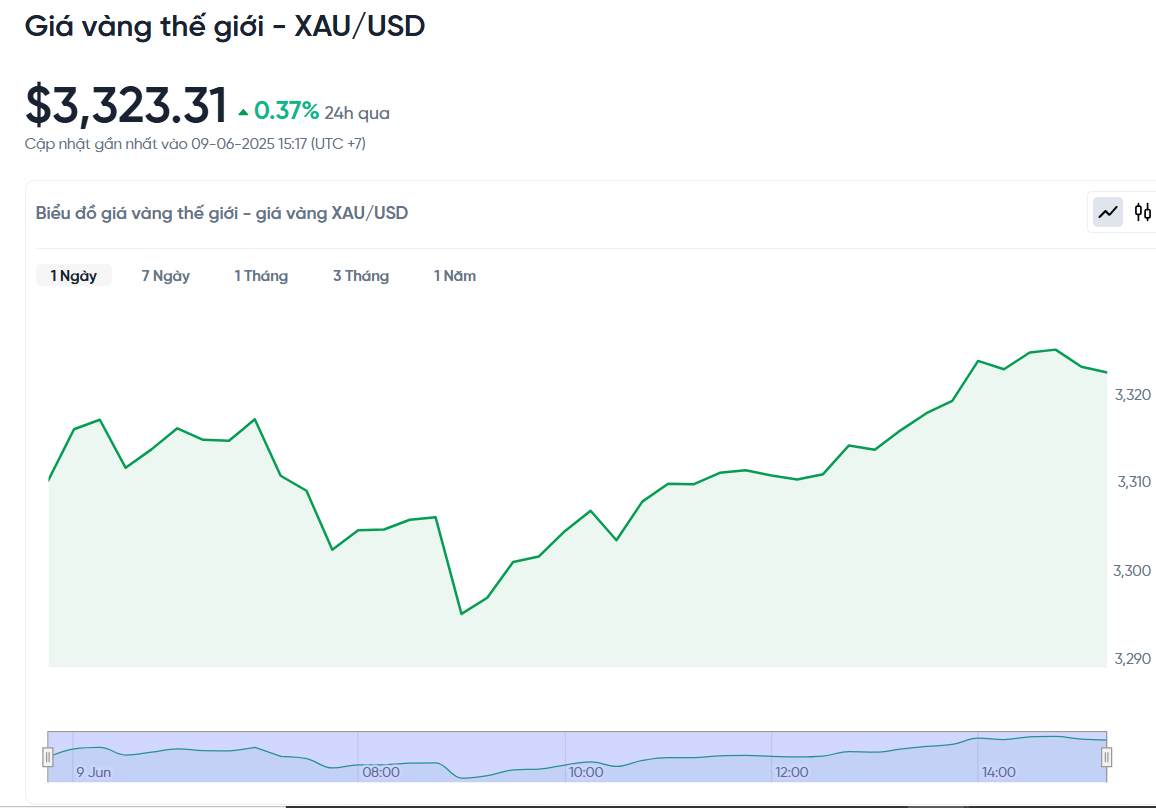

Update gold price this afternoon June 9, 2025 in the world

At the time of trading at 3:30 p.m. on May 30, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,323.31 USD/ounce. Converted according to the USD exchange rate on the free market (26,220 VND/USD), the world gold price is equivalent to about 105.15 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (115.7-117.7 million VND/tael), the SJC gold price is currently about 11.85 million higher than the international gold price.

The US-China talks in London are expected to bring some positive signs. While trade tariffs may not disappear completely, a deal could reduce the cost of doing business in the US. This is important because the cost of doing business in the US is quite high and the country’s budget deficit is growing. These factors could lead to higher inflation, which could be good for gold, which is often seen as a safe haven in times of economic uncertainty.

Technically, experts predict that spot gold prices may fall to the support level of $3,296 per ounce. If gold prices break this level, it may continue to fall further, to around $3,262. These figures show that the gold market is in a sensitive phase, easily affected by important economic news.

Another factor influencing gold prices today is the US jobs report. The latest data showed that new jobs exceeded expectations, wages rose sharply and the unemployment rate remained unchanged. This led investors to think that the US Federal Reserve (Fed) may only cut interest rates once this year, instead of the two previously expected. US inflation data, due on Wednesday, will provide further clues on the direction of interest rates and gold prices.

In addition, US President Donald Trump has mentioned that he will soon announce the decision on the position of the new Fed chair. He emphasized that a good Fed chair will prioritize lowering interest rates. When interest rates are low, gold often becomes more attractive because it is not affected by the high opportunity cost of other interest-bearing assets. This is why gold is favored in low-interest-rate environments and when the global economy is unstable.

Another noteworthy piece of information is that China, one of the world's largest gold buyers, has increased its gold reserves for seven consecutive months, as of May 2025. This shows that gold is still considered a strategic asset to protect value in the context of many risks in the global economy.

In addition to gold, other precious metals also saw volatility. Silver edged up 0.2% to $36.03 an ounce, while platinum rose more sharply to $1,187.80. Palladium, on the other hand, fell slightly to $1,045.61. These moves reflect the complexity of the precious metals market, where gold remains central to its safe-haven status and enduring value.

In summary, the gold price today, June 9, 2025, on the world market is being affected by many factors, from trade negotiations, US economic data, to the Fed's interest rate policy. Although the current gold price is stable, upcoming developments, especially inflation data and the Fed's decision, can create big changes. For those who are not familiar with economics, it is important to remember that gold often increases in price when the world is unstable or interest rates are low, and following major news will help better understand the gold price trend in the coming time.

Source: https://baoquangnam.vn/gia-vang-chieu-nay-9-6-2025-gia-vang-trong-nuoc-tang-tu-vai-tram-den-trieu-dong-luong-3156379.html

![[Photo] President Luong Cuong talks on the phone with South Korean President Lee Jae Myung](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/13/eee54a4c903f49bda277272b1dda68e8)

Comment (0)