Silver price today

Today's silver price is listed by Phu Quy Gold and Gemstone Group ( Hanoi ) at 1,346,000 VND/tael (buy) and 1,388,000 VND/tael (sell), an increase of 44,000 VND/tael for buying and 46,000 VND/tael for selling compared to yesterday morning's trading session.

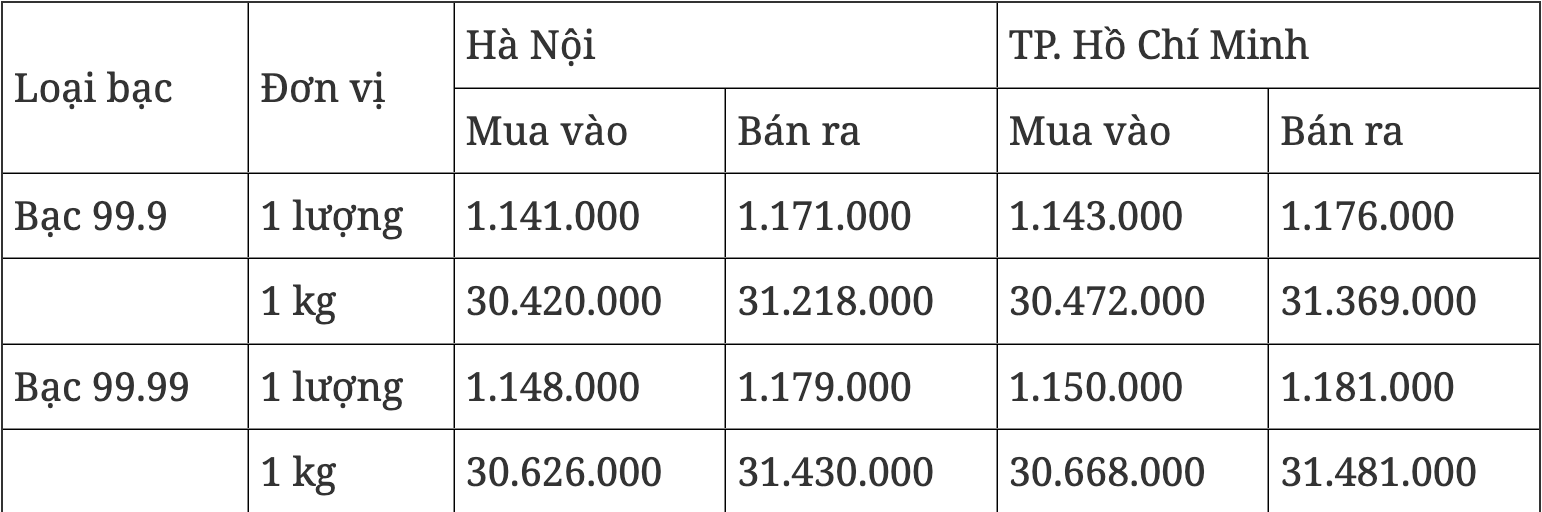

Also in Hanoi, according to a survey at other trading locations, silver prices are currently listed at VND1,141,000/tael (buy) and VND1,171,000/tael (sell), also up VND44,000/tael in both buying and selling compared to yesterday morning's trading session.

Similarly, in Ho Chi Minh City, silver prices also increased, currently at VND1,143,000/tael (buy) and VND1,176,000/tael (sell), up VND44,000/tael in both buying and selling compared to yesterday morning's trading session.

Latest information on silver prices in Hanoi and Ho Chi Minh City on June 7, 2025:

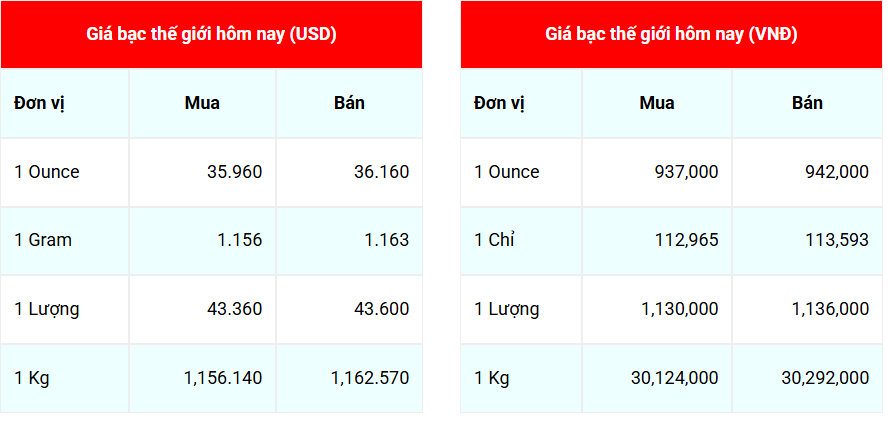

World silver price

In the world market, according to giabac.net, at 06:20 on June 7, the spot silver price stopped at 35.976 USD/ounce, an increase of 0.253 USD/ounce compared to yesterday morning's trading session.

Previously, the silver price listed on Goldprice.org was at 35.86 USD/ounce, up 1.21 USD/ounce compared to yesterday morning's trading session.

The world silver price is currently at 937,000 VND/ounce (buy) and 942,000 VND/ounce (sell), an increase of 5,000 VND/ounce in both buying and selling prices compared to yesterday morning's trading session.

While silver’s rise was largely driven by technical factors, broader market factors also supported prices. The US dollar is currently not a major obstacle, while inflation concerns have increased interest in safe-haven assets like silver.

"The increase in steel tariffs and trade tensions between the US and China have boosted safe-haven sentiment, primarily gold. This has also helped silver benefit from its dual role as an industrial metal and an investment asset," said James Hyerczyk, a market analyst.

The market is now focused on US employment data, with non-farm payrolls due to be released on June 6, he added.

“If the jobs data is good, it could delay a rate cut, helping the US dollar strengthen and reducing investment in silver.

On the contrary, if the jobs data is not as expected, silver will benefit as traders adjust their expectations for the US Federal Reserve's monetary policy," said James Hyerczyk.

Source: https://baodaknong.vn/gia-bac-hom-7-6-duy-tri-xu-huong-tang-254871.html

![[VIDEO] - Impressions of Quang Noodle Festival - Dien Ban 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/9/e44633e236e84f408912a95a401faef3)

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)