Bad debt escalates under Chairman Dao Manh Khang

There was a time when ABBank was one of the banks with a tightly controlled bad debt ratio, maintained below 3% for many consecutive years. However, since Mr. Dao Manh Khang - who has a friendly relationship with another figure in the group's ecosystem - took office as Chairman of ABB's Board of Directors in April 2018, the bad debt picture at the bank has begun to have worrying changes, especially from 2022 onwards.

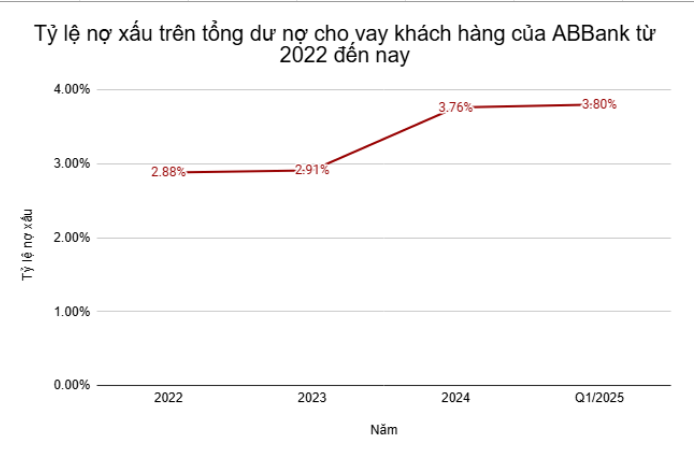

By the end of 2022, after many years of maintaining a low NPL ratio, ABBank's on-balance sheet NPL had increased to 2.88%. By mid-2023, the situation became more serious when this ratio escalated to 4.55% - the highest level since 2014. This was the period when ABBank was forced to increase its provisioning, severely affecting profits.

Subsequent restructuring efforts have helped ABBank somewhat reduce the bad debt ratio. By the end of 2023, the NPL ratio had cooled down, however, according to the audited consolidated financial statements, the actual NPL was still at 2.91% - showing that credit risks have not been thoroughly handled.

By the end of 2024, the ratio of bad debt to total outstanding customer loans continued to increase again, to 3.76%, significantly higher than the control target of below 3% that Chairman Dao Manh Khang had announced to shareholders.

Entering early 2025, ABBank's bad debt picture has not shown any signs of improvement, and has even increased. At the end of the first quarter of 2025, the bank recorded a total bad debt on the balance sheet of VND 3,729 billion, equivalent to 3.80% of total outstanding customer loans, up slightly compared to the end of 2024.

The evolution of the debt structure also clearly reflects the continuing downward trend in credit quality. Compared to the end of 2024, substandard debt (group 3) decreased slightly from VND 630 billion to VND 613 billion, and doubtful debt (group 4) decreased from VND 954 billion to VND 838 billion. However, debt with the potential for capital loss (group 5) - the most serious and difficult-to-recover bad debt group - increased sharply from VND 2,107 billion to VND 2,278 billion, an increase of 8.1% in just one quarter.

The decrease in group 3 and group 4 debts does not reflect a real debt settlement process, but mainly because these debts have shifted to group 5 - the debt group with the highest risk of capital loss. This shows that ABBank's bad debt structure is increasingly leaning towards the most serious debts, increasing the pressure on settlement and provisioning in the coming quarters.

With the above developments, the target of controlling NPL to below 3% and striving for 2% in 2025, which ABBank's Board of Directors set at the 2025 General Meeting of Shareholders, is becoming more and more distant. The trend of increasing bad debt from 2022 to now has not shown any signs of slowing down, posing a huge problem for the bank's credit management capacity and debt handling efficiency in the coming time.

Increased risk, inadequate returns

The confusing point is that while the bad debt picture is getting worse, ABBank's profit report recorded positive figures in the first quarter of 2025. Specifically, after-tax profit in the first quarter of 2025 reached 333 billion VND, more than double that of the same period last year.

However, the quality of this profit is not really sustainable. The cost of credit risk provisions in the quarter nearly doubled to VND340 billion, showing that the bank is "paying the price" for increasing risks in the credit portfolio.

In particular, as the bad debt structure is increasingly tilted towards group 5 - the group with the highest risk of capital loss - the risk of having to continue to set aside large provisions in the coming quarters is very clear. This will erode the bank's future profits, despite positive results in the short term.

In addition, ABBank is also facing a large temporary loss from its securities investment portfolio, with a temporary loss of VND 1,150 billion as of the end of the first quarter of 2025 - an increase of more than VND 30 billion compared to the beginning of the year.

Demand deposits (CASA) - a cheap source of capital that helps improve profit margins - also recorded a sharp decline of 16% compared to the previous quarter, partly reflecting the decline in customer confidence.

In addition, ABBank's NIM (net interest margin) continues to lag behind the industry average. In the first quarter of 2025, the bank's NIM reached only 1.97%, almost "at the bottom" compared to other banks which maintained a 3-5% level.

Thus, the strong profit growth in the first quarter of the year can hardly obscure the picture of deteriorating asset quality and the potential risks in ABBank's credit portfolio. The question is who have been and are the main borrowers of this bank? According to Thuong Truong's sources, some of them are related to the ecosystem of a large corporation in Vietnam. We will continue to inform in upcoming articles.

Source: https://baodaknong.vn/duoi-thoi-anh-em-chu-cich-dao-manh-khang-no-xau-abbank-abb-leo-thang-sang-2025-van-chua-co-dau-hieu-ha-nhiet-255264.html

Comment (0)