Closing session 4-8, VN-Index closed at 1,528 points

VN-Index exploded up 33 points

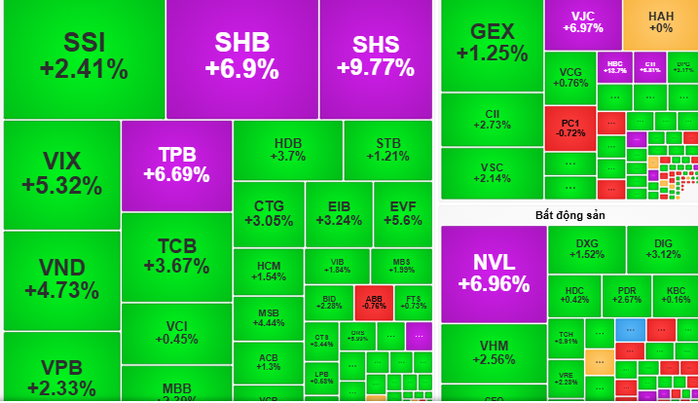

VN-Index opened the trading session on August 4 hovering around the reference level for the first 30 minutes, before breaking out strongly thanks to the push from large-cap stocks. Notably, stocks belonging to Vingroup such as VIC (ceiling price) and VHM (+2.56%), along withSHB (ceiling price) in the banking group, showed an impressive recovery after the correction last week. These stocks played an important role, helping the index widen its increase range and end the morning session with an increase of more than 12 points.

Midcap stocks also recorded strong demand, especially in the Electricity, Aquaculture and Real Estate sectors. Of which, ANV increased by 5.46%, NT2 hit the ceiling, and NVL achieved an increase of 5.22%.

In the afternoon session, the strong increase in demand, combined with the consensus from the large-cap group, pushed the VN-Index closer to the 1,530-point mark at the end of the session. The green color spread positively with 242 stocks increasing, of which 21 stocks hit the ceiling, compared to 89 stocks decreasing, reflecting the excitement of investors. The industry groups leading the increase included Banking, Real Estate, Securities, and Electricity.

At the end of the session, VN-Index closed at 1,528 points, up 32.98 points (equivalent to 2.21%).

Latest moves by foreign investors

Foreign investors continued to net sell in the session of August 4, but the pressure has decreased significantly, with a total net selling value of VND371.78 billion. The stocks that were sold heavily included SSI, VIC, and VHM, of which VIC was under the greatest pressure with a net selling value of nearly VND1,000 billion. However, the cooling signal from foreign investors' net selling is a positive factor, creating more confidence for domestic investors.

According to Vietcombank Securities Company (VCBS), VN-Index recorded an impressive recovery session on August 4, led by large-cap stocks and the spread of green in the market. With this strong increase, investors expect VN-Index to continue to advance further in the session on August 5, with the main driving force coming from large codes such as VIC, VHM, SHB, and stocks in the banking, real estate, and securities groups.

Some other securities companies recommend that investors maintain their weight in stocks that are recovering well, especially those in the large-cap group; they can partially disburse into stocks with impressive business results in the second quarter of 2025 with short-term investment goals. At the same time, stock players need to closely monitor supply-demand developments and foreign investors' movements because the VN-Index is in a sensitive area. The possibility of market fluctuations may occur, requiring investors to be cautious and flexible in their trading decisions.

Source: https://nld.com.vn/chung-khoan-ngay-mai-5-8-ky-vong-vn-index-tiep-tuc-tang-diem-nho-suc-manh-nhom-co-phieu-lon-196250804170459444.htm

![[Maritime News] Two Evergreen ships in a row: More than 50 containers fell into the sea](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/4/7c4aab5ced9d4b0e893092ffc2be8327)

Comment (0)