After the US government announced a temporary tax rate of 10% applied until July 9, seafood businesses immediately seized the opportunity to increase deliveries to the US in April and the first half of May to avoid the risk of being subject to higher taxes (up to 46%) after July 9 - the end of the 90-day temporary tax period. This helped seafood export turnover in April increase sharply by over 900 million USD and in May by 851 million USD, contributing to an estimated 5-month seafood export turnover of 4.2 billion USD, up 18.2% over the same period. However, according to some businesses, exports to the US have gradually decreased since mid-May and this move is to prevent trade risks.

|

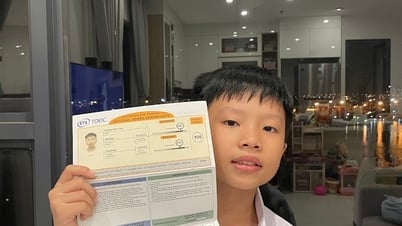

| Diversifying markets and seafood export products is one of the escape strategies of enterprises in the context of increasing trade risks. Photo: TICH CHU |

Shrimp is still the bright spot of the seafood industry, reaching 363 million USD in May, up sharply by 12.4% and accounting for more than 42% of total turnover. In the first 5 months of the year, shrimp exports reached more than 1.66 billion USD, up 28.3%. Commenting on the above export results, businesses said that the above figures clearly reflect the clear recovery trend of the market and good demand from the US, Japan and CPTPP countries. However, facing the instability of the US's reciprocal tax policy, many seafood businesses have been redefining their market strategies towards diversification and increased deep processing. The above diversification strategy is considered a way out for businesses in the context of increasing trade risks.

Not only the export turnover value, the shift in product structure is also a bright spot of the industry in the first 5 months of the year. Value-added processed products, such as: breaded pangasius, processed squid, or frozen octopus, all recorded strong growth, reflecting the trend of meeting the demand for convenient and high-end consumption in major markets. This shows that Vietnamese enterprises are investing heavily in processing technology and diversifying products to increase competitiveness. However, to maintain growth momentum, in addition to the efforts of enterprises and VASEP, the industry really needs a stable supply of raw materials as well as support policies from the Government such as: debt extension, interest rate reduction and simplification of administrative procedures so that enterprises can overcome financial difficulties.

However, the journey to conquer the international market is not easy. The United States, a large market, is applying a new tariff policy, especially a 10% tax on processed products. Not only that, the risk of reciprocal tariffs of up to 46% along with anti-dumping and anti-subsidy tariffs on shrimp and pangasius, along with the expanded SIMP program and strict traceability requirements, are putting Vietnamese businesses under great pressure. The Marine Mammal Protection Act (MMPA) is also a big challenge because Vietnamese seafood may face the risk of an import ban from 2026 if the necessary procedures do not meet US requirements.

In the EU, the IUU yellow card continues to be a barrier, causing delays in certification and disrupting shipments. Despite its strong growth, China faces competition from domestic products and pressure from quality control. In addition, rising production costs, from raw materials, feed, to logistics, along with a shortage of containers and rising freight rates, are reducing business profit margins. Faced with these challenges, businesses have flexibly shifted to potential markets such as Japan, South Korea, ASEAN, and the Middle East, taking advantage of free trade agreements. Promoting deep processing and developing value-added products not only helps increase turnover but also reduces dependence on volatile traditional markets.

According to VASEP, from now until July - when the US will decide on the official tax rate for some products from Vietnam - it is expected that exports to this market will continue to be cautious. Businesses need to calculate reasonable delivery times to avoid tax risks and not lose orders. According to the scenario set by VASEP, if the tax rate remains at 10% after July 9, the seafood industry can maintain stable exports, but if the tax rate of 46% is applied, export activities will decrease significantly and force a more drastic market restructuring. Therefore, according to VASEP's recommendations, in the long term, the industry needs to take advantage of free trade agreements (FTAs) such as CPTPP, EVFTA, UKVFTA to expand the market, while upgrading infrastructure, reducing logistics costs and increasing the ability to meet international standards. The government also needs to have credit policies, support farming areas and invest in processing to increase the competitiveness of the whole industry.

The US is the leading market for Vietnamese shrimp, so Mr. Ho Quoc Luc - Chairman of the Board of Directors of Sao Ta Food Joint Stock Company commented: "This tariff affects the global trade situation, not just our country; but considering the shrimp industry alone, our shrimp is at a disadvantage because the shrimp tax rate from competitor countries is much lower."

In the context of the constantly fluctuating global market, the Vietnamese seafood industry has demonstrated its mettle and made its mark not only by its flexible adaptation and efforts to overcome increasingly stringent trade barriers, but also by its impressive growth figures over the past 5 months. Hopefully, this mettle and adaptation will continue to be promoted by businesses to further consolidate the industry's position in the world market.

ACCUMULATE

Source: https://baosoctrang.org.vn/kinh-te/202506/ban-linh-va-su-thich-ung-linh-hoat-0843c32/

![[Media] Supporting women in starting a business](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/13/3894920bed774522ac6aa4370c215cd8)

Comment (0)