BBC (UK) quoted Mr. Tan Yew Kong at GlobalFoundries company branch in Singapore saying: "Tell us what you want, what design you like and we will produce it for you."

At this point, GlobalFoundries is tailoring its future plans to adapt to US President Donald Trump's unpredictable tariff policies.

Many countries are rushing to negotiate with the Trump administration as the clock counts down to the deadline for tariff suspensions. In April, President Trump announced a series of reciprocal tariffs on trading partners, but delayed implementation for many countries for 90 days to allow for negotiations, with the deadline set for July 9.

It is still unclear what will happen next.

AFP news agency (France) reported on July 7 that President Trump confirmed that he had begun sending the first letters on tariffs and trade agreements to other countries. The US leader posted on the social network Truth Social: "I am pleased to announce that the US tariff/agreement letters with many countries around the world will be sent starting at 12 noon on Monday, July 7 (local time)".

Semiconductors have so far been exempt from tariffs, but Trump has repeatedly threatened to impose tariffs on them. The uncertainty makes it nearly impossible for businesses to plan for the future. In early July, Bloomberg reported that the White House was planning to further tighten controls on artificial intelligence (AI) chips by restricting shipments to Malaysia and Thailand to tackle smuggling of the technology to China.

For his part, Mr. Tan Yew Kong shared that this makes it difficult for businesses to plan long-term. GlobalFoundries, where Mr. Tan Yew Kong works, has factories in many places around the world, including India and South Korea. GlobalFoundries, headquartered in the US, is contracted by some of the world's largest semiconductor designers and manufacturers such as AMD, Broadcom and Qualcomm to manufacture their chips. GlobalFoundries recently announced plans to increase its investment to $16 billion as demand for AI hardware skyrockets. GlobalFoundries also pledged to the Trump administration to move some of its chip production and supply chain to the US.

Chipmakers, textile companies and auto parts suppliers with tight supply chains running through Asia are rushing to fulfill orders, cut costs and find new customers amid the uncertainty.

“Companies need to rethink their safety stock levels, increasing inventories and extending lead times to accommodate volatility,” said Aparna Bharadwaj of Boston Consulting Group. This could create new opportunities, she added, but also impact their competitiveness and market share in certain countries. In other words, uncertainty is the new normal .

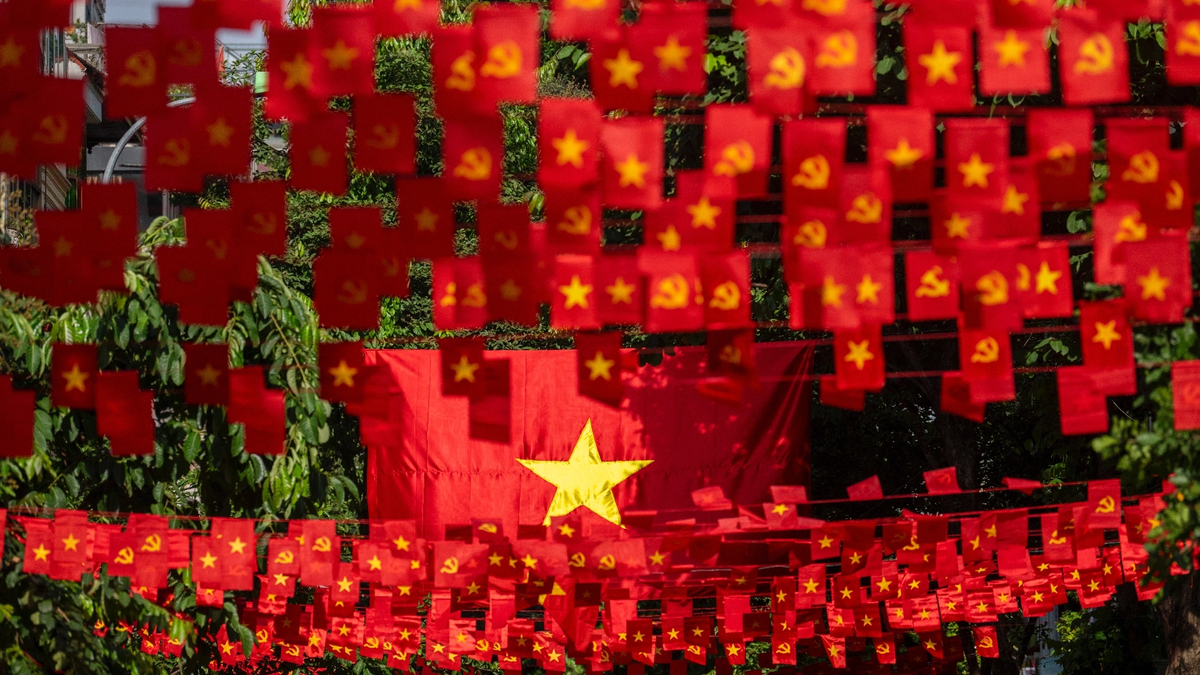

The Malaysian prime minister has said tariffs would hurt many industries, including textiles, furniture, rubber and plastics. Southeast Asian countries account for 7.2% of global GDP by 2024. So the costs of tariffs could be severe and long-lasting. In the region, only Vietnam has reached an agreement with the US.

In Asia, Japan and South Korea have pursued trade talks during the tariff pause. And as the deadline approaches, President Trump has threatened Tokyo with even higher tariffs — as high as 35%. Japanese automakers could be among the hardest hit. Companies like Mazda say they are in survival mode because of the time and process involved in changing suppliers and adjusting their operations.

Indonesia and Thailand have offered to increase imports and reduce tariffs on US goods. Countries like Cambodia, which faces a whopping 49% tariff, cannot afford to buy more goods from the US.

"Asian economies are dependent on both China and the US... they are almost at the center of the global supply chain. If there is a change in the global supply chain and in the trading patterns, they will face more difficulties," said Professor Pushan Dutt at INSEAD business school.

Countries with large domestic demand like India could be protected from the trade shock, but economies that rely more on exports - like Singapore and even China - would face a big hit, Mr. Pushan Dutt added.

Ms Bharadwaj assessed that the US is an important market for many countries, adding: “No matter how tariffs change, the US will remain an important customer for many Asian businesses. The US is the world’s largest economy, with a dynamic consumer market.”

In addition to hitting Southeast Asian manufacturers, President Trump’s tariffs will also raise costs for U.S. companies that have operated in the region for decades. Some U.S. companies have said they will have to pass the increased costs onto their products, leading to higher prices for customers.

Experts also assess that foreign investment may shift from Laos and Cambodia to countries with lower tariffs such as the Philippines, Singapore, Malaysia and Indonesia. Businesses may also seek new customers - with the European Union (EU), the Middle East and Latin America as potential markets.

“We are no longer global, we are more regional,” said Mr Tan of GlobalFoundries. “Go where we feel safe and the supply will be maintained. But people will have to get used to the fact that the product is not as cheap as before.”

The US-Vietnam deal is only the second trade deal to be announced so far. Until more are signed, businesses and economies in Asia may have to navigate a new path.

Professor Dutt sums up what is happening with an old proverb: “Bow to the ruler, then go your own way.”

Source: https://doanhnghiepvn.vn/doanh-nhan/doanh-nghiep-chau-a-tim-cach-thich-ung-voi-thue-quan-cua-tong-thong-trump/20250708081952972

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)