At the beginning of this morning's trading session (September 5), VN-Index easily conquered the 1,700-point mark - the highest ever. At 9:47, the index increased by 5.5 points to 1,701.66 points. Green dominated both floors, with HoSE liquidity exceeding VND7,400 billion.

The VN30 large-cap stocks group mostly moved in green, but still could not conquer the resistance level of 1,900 points.

Banking stocks such as TCB,ACB , MBB, VPB still have a strong impact, contributing to the leading role of the index. In addition, there are some other large-cap stocks such as VIC, SSI, MSN, VJC...

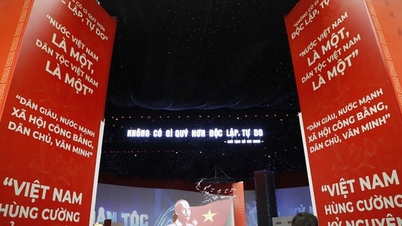

Stocks surpass 1,700 points (Illustration: Dang Duc).

In just the first minutes of trading,SHB (Saigon - Hanoi) shares recorded a large trading volume of over 21.5 million units. Next was HPG (Hoa Phat) with nearly 12 million units.

Steel stocks are divided this morning after yesterday's exciting trading. Some stocks are falling, such as HPG and HSG; some are flat, and a few others are slightly up.

Pillar stocks related to the " Vingroup family" all increased, such as VIC, VRE, VPL, except for VHM, which decreased by nearly 2%.

The stock market is excited in the context of the upcoming FTSE review to upgrade from frontier market to emerging market on October 7. Vietnam has met 7/9 necessary criteria, the remaining two criteria on payment cycle and transaction failure costs have also made significant progress.

HSBC has just estimated that in an optimistic scenario, FTSE's upgrade could help Vietnamese stocks attract a maximum of 10.4 billion USD from foreign capital flows.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-vuot-dinh-1700-diem-20250905095415773.htm

![[Photo] Politburo works with the Standing Committees of Vinh Long and Thai Nguyen Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/4f046c454726499e830b662497ea1893)

![[Photo] Politburo works with the Standing Committees of Dong Thap and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/3e1c690a190746faa2d4651ac6ddd01a)

![[Photo] Amazing total lunar eclipse in many places around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/7f695f794f1849639ff82b64909a6e3d)

Comment (0)