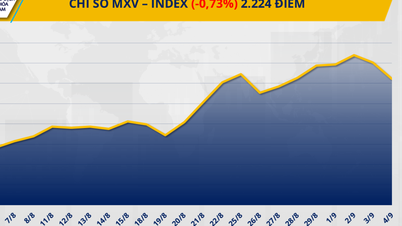

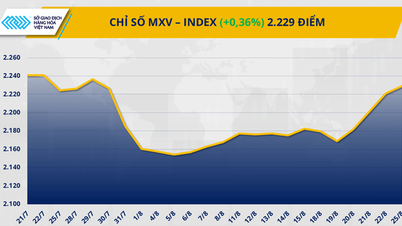

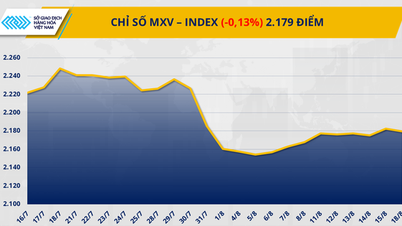

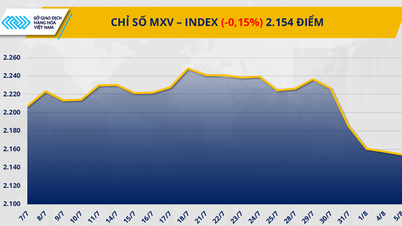

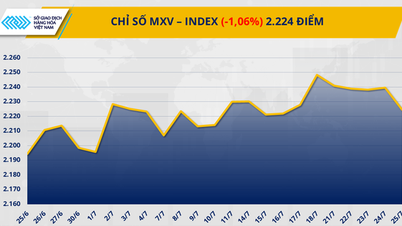

According to the Vietnam Commodity Exchange (MXV), after three consecutive sessions of decline, the world raw material market returned to an upward trend yesterday when green spread across most commodity groups, pulling the MXV-Index up nearly 0.7% to 2,225 points.

The highlight is the industrial raw material group, when coffee prices increased sharply amid growing concerns about the risk of supply shortage.

In the metal group, optimism about the prospect of consumption demand in China continued to support iron ore prices, helping this commodity extend its increase streak to the fifth consecutive session.

Closing yesterday's trading session, the industrial raw material market witnessed strong buying power with 7 out of 9 commodities increasing in price; in which, the price of Arabica coffee for December contract increased by 3% to 8,484 USD/ton while the price of Robusta coffee also recorded an increase of more than 2.8% to 4,430 USD/ton.

The world coffee consumption market is facing a shortage of Arabica coffee in the 2025-2026 crop year.

According to the latest report of Conab, the output of this type of coffee decreased by more than 4 million bags (equivalent to 11.2%), down to more than 35 million bags. This decrease is equivalent to 1/3 of the Arabica output of the second largest producer, Colombia, which was forecast by the US Department of Agriculture at 12.5 million bags.

If this scenario becomes a reality, the market will face the reality that no country will be able to fill this supply gap in the global market.

In addition, the outlook for Brazil's coffee output in the 2026-2027 crop year is also raising concerns in the market, as the country has just experienced unusual weather phenomena not recorded in at least the past 4 years in its main growing regions.

According to a study by the Cerrado Coffee Exporters Cooperative (Expocacer), the frost that occurred on August 11 could reduce the production potential of the next crop by about 5.5%, equivalent to the loss of about 412,000 bags of coffee.

However, the upward momentum of coffee prices was somewhat restrained after US President Donald Trump recently signed an executive order reducing reciprocal taxes to 0% on many products that the US cannot produce, exploit or meet domestic demand.

Accordingly, coffee is on the list of products proposed to be exempted from tax, contributing to somewhat limiting the growth of this item in the international market.

In the domestic market, Vietnam Customs reported that coffee exports in August increased by 11% compared to the same period last year, reaching 84,000 tons. However, the cumulative amount of coffee exports in the first 11 months of the current coffee crop year (from October 2024 to September 2025) was recorded to be 45,500 tons lower than the same period last year, with a total volume of 1.3 million bags.

In addition, the General Statistics Office of Vietnam also said that the value of coffee export turnover in the first 8 months of 2025 reached about 6.50 billion USD, a sharp increase of 61.1% over the same period last year.

Regarding production, by the end of August, the new coffee harvest in the Central Highlands had just begun in some provinces with early harvests but output was still very limited.

The main crop is expected to start in late October and peak in November. Ending stocks are showing signs of tightening. Coffee trading in the first week of the month was somewhat gloomy, with farmers holding off on sales, waiting to see how prices develop, while warehouses showed no clear buying activity.

Meanwhile, not outside the general market trend, the metal group also recorded green covering most of the key items in the group.

Notably, iron ore prices continued to rise yesterday, up 0.55% to $105.42/ton - the highest level since late February, marking a streak of five consecutive increases.

The main driver came from market expectations on consumption prospects in China, as the country imported more than 105.2 million tonnes in August, up slightly from July.

Analysts believe that this increase in imports is to prepare raw materials for the production phase after many steel factories temporarily reduced capacity before the September 3 military parade in response to the government's request to cut emissions.

In addition, optimism is also reinforced by expectations that Beijing will launch more infrastructure investment stimulus measures to support growth, thereby boosting demand for steel and input materials such as iron ore.

However, actual demand has not really improved as iron ore inventories at Chinese ports increased by nearly 1.2 million tonnes to 131.5 million tonnes in the week ending September 5, indicating that most of the new imports are still in warehouses.

On the other hand, the risk of price adjustment still exists when the macroeconomic picture in China has not improved significantly.

The property sector continued to be sluggish, with new home sales by the top 100 firms in August down 17.6% year-on-year, while the manufacturing PMI stood at 49.4 - a fifth straight month of contraction.

In Vietnam, the international iron ore price remaining above 100 USD/ton over the past month has contributed to the increase in domestic steel prices since September 8, with CB240 coil steel at 13.5 million VND/ton and D10 CB300 rebar steel reaching 13.09 million VND/ton.

On the trade front, August recorded iron and steel imports of more than 1.3 million tons, up 17% over the previous month, while exports decreased 17.5% to about 654,000 tons.

Source: https://baolaocai.vn/gia-ca-phe-dao-chieu-tang-manh-post881636.html

![[Photo] Close-up of 3,790 resettlement apartments in Thu Thiem to continue auction](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/be974e2058f74c9c8dc1f400124f3653)

![[Photo] Experience at the Exhibition of 80 years of national achievements - Meaningful activity for new students](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/286061b79abb4afa8961d730c9833cdd)

Comment (0)